Trade Plan for 9/8-9/12

4 weeks of chop and the indices have gone nowhere - Time to move?

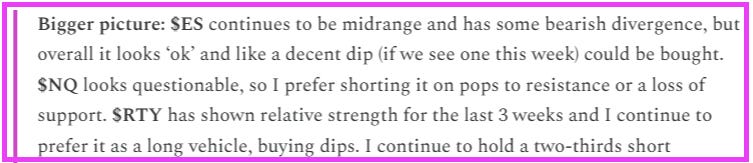

Last week I continued my strategy of shorting pops to resistance on $NQ/Nasdaq futures and to also potentially buy any $RTY/small caps futures dips to hold for a long. My ‘bigger picture’ view was spot on as the $ES/SPX futures dip was bought and the week closed slightly up.

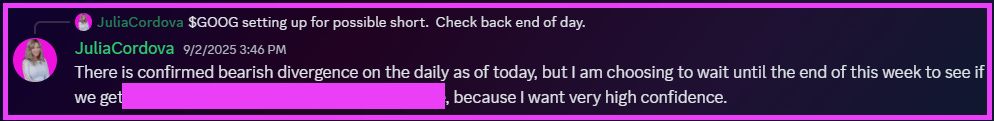

On review of the week, we saw $RTY continue to hold relative strength over $NQ ✅, but interestingly $NQ held slight relative strength over $ES after several days of remarkable Market On Close buying. 👀 I have continued to swing other overbought tech stocks short and as I believe it is the best short term swing strategy. So far, I have been correct. I was tempted to add a short $GOOG position to my swings last week, but thankfully I was cautious as I prefer high probability shorts in this market environment at this time.

It ripped higher after hours on this day. Phew! I’d say this level of patience was a win! 😅

I was slightly optimistic once again for precious metals, but I advised to take some profit at resistance levels.✅💰

I was watching for possible rotation into $XOP/oil equities, because of a breakout from the week before, but it closed just back on that breakout backtest.👀

Summary of Market Action Last Week:

Tuesday’s indices dip was bought and we saw a grind upwards into a volatile Friday. Ultimately all the indices closed with a slight gain. Both $ES/SPX futures and $NQ/Nasdaq futures have closed near flat for 4 weeks now, setting up a large move incoming.

$GDX/Gold miners outperformed the broad market once again (again) this week. $GC/Gold futures clawed back relative strength from $SI/Silver futures.

$CL/Crude Oil futures and $XOP/oil equities declined on the week in volatile range trading.

Here’s how last week closed out:

For the week ahead (09/08 - 09/12/25)