Trade Plan for 9/4-9/8

September is here, but what about the Fall?

Last week I was prepared for the market to move in either direction as there was a case to be made for both, but I kept a bullish bias once again primarily because of $RTY/small cap futures being in a ‘do or die’ place:

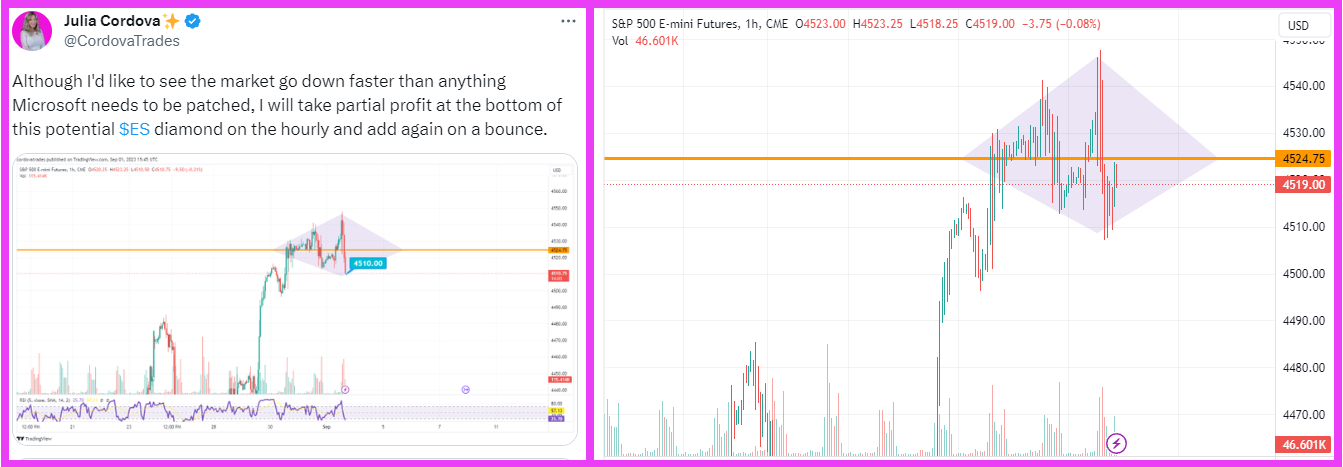

$RTY barely ticked down from where it opened last Sunday night.🔮 My weekly and daily levels performed well and I shared an hourly diamond on Twitter Friday for those who weren’t watching it with me and scalping in Discord. Here’s the tweet and subsequent price action:

I continued to be bullish on precious metals and my support and resistance levels worked well. 💰✅

I was minimum confidence bearish once again on crude oil for the week, but noted:

The high for crude for the week on Friday was 86.06. ✅🎯

This week @SLMacro looks at a stock he feels has great long term potential.

Summary of Market Action Last Week:

The markets had strong upward days on Monday and Tuesday, then chop consolidated upwards for the rest of the week. $NQ/Nasdaq futures once again printed the biggest gain on the week, while $RTY/small caps made up for underperformance in the prior week.

$GDX/gold miners continued upward momentum, but was thwarted at resistance, along with $SI/silver futures and $GC/gold futures.

$CL/Crude Oil futures broke out impressively and outperformed along with $XOP/oil equities.

Here’s how last week closed out:

For the week ahead (9/4-9/8/23)