Trade Plan for 9/29-10/3

Leaves Fall, Markets stall: Your Autumn Trading Haul!

Last week I didn’t have a strong bias once again because price action is between important weekly levels. I simply looked for good hourly setups. There were 2 that stood out as straight forward to the start the trading day that I noted in my morning levels. The first was ‘Tuesday Plan Rectangularization’

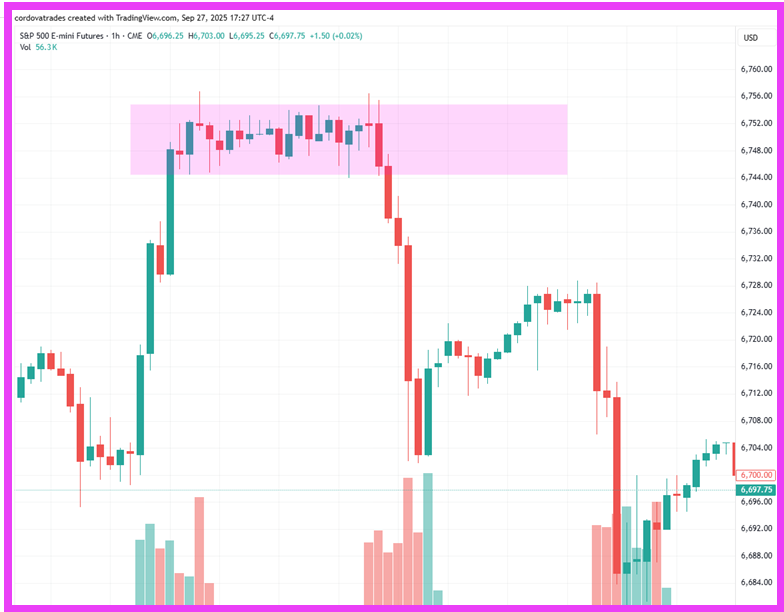

You can see we got a clean breakdown of that tight ‘rectangularization’ making for a great trade (as we declined over 40 points):

The next great day-trade setup was from the top of the second of a h&s formation on the hourly the next day. We caught the top of the second shoulder with ease:

I have continued to swing some overbought tech shorts, as opposed to shorting the indices directly for any extended period of time, because I believed (and still believe) that trade is the safest contrarian bet in the intermediate term.

I was mostly neutral for metals once again, but constructive on $GDX/gold miners. Silver opened right above the VERY important resistance I mentioned last week and never looked back.

$CL/crude oil futures finally got a sizeable move last week, as XOP 0.00%↑ got follow through on a breakout from over a month ago.

Summary of Market Action Last Week:

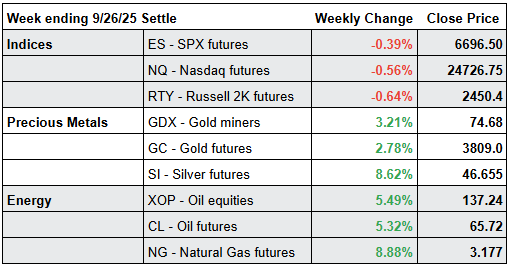

The indices made higher highs and higher lows last week, but each still closed the week slightly lower amid choppy trading.

$GDX/Gold miners outperformed the broad market for the fifth time this week. $SI/Silver futures was the big outperformer last week.

$CL/Crude Oil futures and $XOP/oil equities both advanced on the week after many weeks of consolidation.

Here’s how last week closed out:

For the week ahead (09/29 - 10/3/25)