Trade Plan for 9/25-9/29

Is the cat dead and if so how high can it bounce?

Last week I amped up my overall bearish confidence from the week before✅, but I was most confident in my gameplan for the beginning of the week before the Fed decision. Here’s what I wrote as a general summation:

Monday’s $ES/SPX futures candle was a near perfect doji (chop exhibited in candle form)✅🎯 and we resolved lower into Tuesday, so I took the resolution short, then used my levels to guide me for the countertrend long scalp and took partial profit before closing the rest near highs.

I was more confident that precious metals would have a bullish week. Results were mixed there, because although $SI/silver futures closed higher on the week, $GC/gold futures closed essentially flat and $GDX/gold miners declined in line with the indices. My levels worked quite well though as the high of the week for $GDX was 31.13 vs my 31.11 🍸martini level:

I was low confidence bearish crude oil but instead of focusing on the commodity I shorted $XOP/oil stocks as I felt that if tech stocks went higher, money would flow out of energy and that if the market went lower, energy would be unlikely to continue upwards.✅💰

Summary of Market Action Last Week:

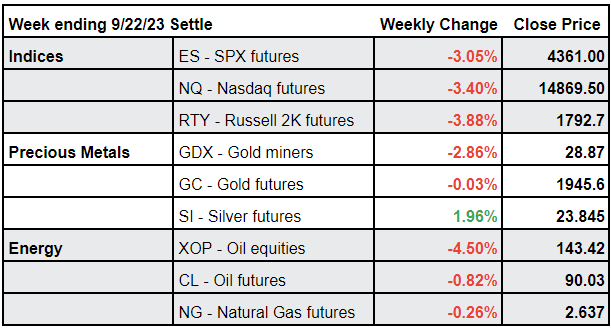

The indices chopped on Monday, resolved lower into Tuesday and then stabilized higher into the Fed decision on Wednesday. The decision was bearish and all 3 indices declined into the end of the week with no appreciable bounce.

$GDX/gold miners sunk in line with the market and $GC/gold futures closed essentially flat, while $SI/silver futures were able to hold onto a nice gain.

$CL/Crude Oil futures chopped to form an indecision doji candle on the week and closed red. $XOP/oil equities continued to decline disproportionately to the commodity.

Here’s how last week closed out:

For the week ahead (9/25-9/29/23)