Trade Plan for 9/22-9/26

After 2 weeks of a breakout and the first rate cut, will this week be different?

Last week I neutral for the week, but thought that potentially the market could see some weakness at the beginning of the week because of some confirmed daily divergence for $ES/SPX futures, but by Monday morning it was clear that the tremendous momentum we’ve seen was not going to falter that easily. The only significant dip last week was on FOMC decision day and that one was simply a contract roll gap fill. Because the indices closed flat for the day on that event, I was biased to the upside overnight and that was a great trade. ✅💰

I have continued to swing some overbought tech shorts, as opposed to shorting the indices directly for any extended period of time, because I believed (and still believe) that trade is the safest contrarian bet in the intermediate term.

I was mostly neutral for metals once again, but constructive on $GDX/gold miners. Silver closed right at a VERY important resistance.

$CL/crude oil futures continues to grind in place just under a breakdown. A large move is coming there as well.

Summary of Market Action Last Week:

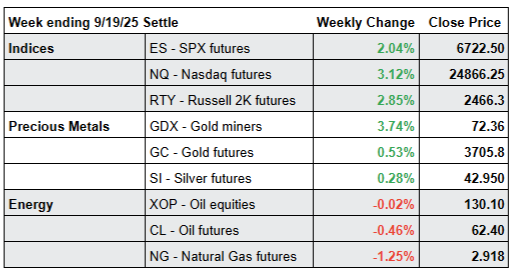

Futures amped upwards out of the gate on Sunday evening and the only notable pullback came on Wednesday. $NQ/Nasdaq futures was the outperformer last week edging out $RTY/small caps futures.

$GDX/Gold miners outperformed the broad market once again (again(again)(again)) this week, but this time it was only by a very slight margin. $GC/Gold futures slightly rose over $SI/Silver futures.

$CL/Crude Oil futures and $XOP/oil equities declined, but continue to coil in a tight range.

Here’s how last week closed out:

For the week ahead (09/22 - 09/26/25)