Trade Plan for 9/2-9/6

Have we broken out yet?

Last week I set bias and traded by the range levels. I would be bullish above $ES/SPX futures 5664.75. That set up a great short out of the gate on Monday and I followed my plan:

That level was an excellent area to short from again on the day after $NVDA earnings. On that same day I wrote “$NVDA looks yuck short term if closes day under 120.11.” I shared that on X as well. You can see the breakdown here (complete with backtest) and it happened to correspond with the fast breakdown of the indices 👽:

That level also marked the top on Friday. For this week I have posted my overall thoughts in a quick weekly video on X.

I was optimistic for both precious metals and $CL/crude oil futures again, but metals lost gains despite indices strength on Friday and oil declined after a significant pop upwards.

Summary of Market Action Last Week:

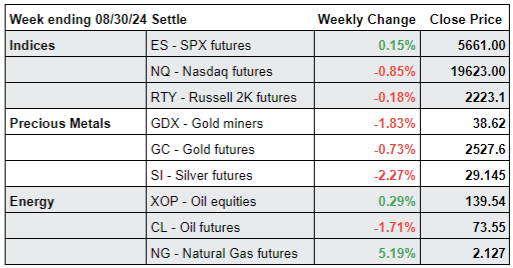

The indices chopped down in a large range into Thursday and then popped back up with a wild 2 hours on Friday, the last day of the month. $ES/SPX futures closed the week with a slight gain, while $RTY/small caps booked a nominal loss. $NQ/Nasdaq futures was the weakest link for the second week in a row.

$GDX/gold miners chopped downwards along with $GC/gold futures, each putting in a lower high and lower low week over week. $SI/Silver futures also closed in the red despite a contract roll to the upside.

$XOP/oil equities continued to outperform the $CL/Crude Oil futures commodity maintaining that discrepancy over the last few weeks.

Here’s how last week closed out:

For the week ahead (09/02 - 09/06/24)