Trade Plan for 9/12-9/16

Is it time to rise and shine?

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Last week I was most confident in metals being bullish for the week🏆 and I wrote that the indices were close to ‘last ditch supports,’ but if $ES/$SPY got all the way to channel support at 3878.75 a test of the lows would become likely (the low of the week was 3883.50). Typically second channel backtests are not good, so I maintained my bullish bias as long as it stayed above there🏆. Because I was long biased this past week - this was one instance I was happy not to have my level hit!😂 I later flipped around for a quick short on the hourly level of 4010 live💰 on Twitch and then flipped long again at daily support, scalping all over the place on Thursday. I did so well over the already shortened week that I took Friday off from active trading. Here was my hourly chart with the daily and weekly levels posted:

$NQ got a nice bounce from about 10 points above what I called the “closest and strongest” support last week.

I also said that the crude oil chart looked dire to me, but $XOP is still in bullish territory so I would welcome a flush to load up on longs. I’ll share this week whether or not the crude oil flush we saw got low enough for me to do that and what my plan is moving forward.

This week @SLMacro answers questions about his macro outlook and investing style.

Summary of Market Action Last Week:

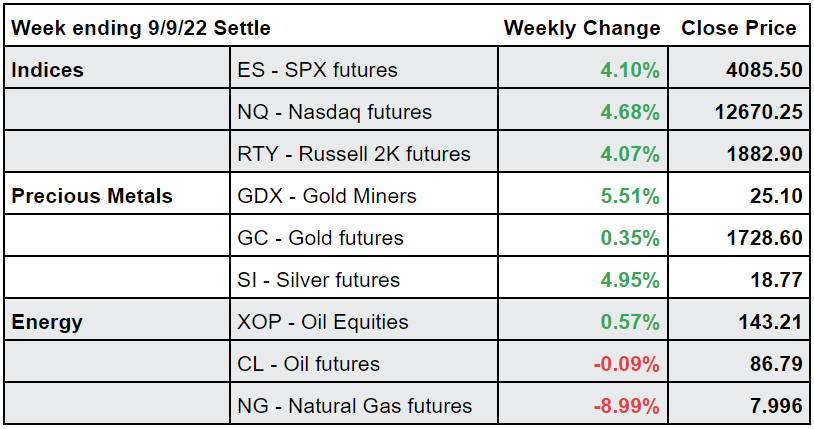

$ES/S&P 500 Futures, $NQ/Nasdaq futures and $RTY/Small caps futures all came close to last ditch supports and bounced closing with significant gains on the week.

$GDX (gold miners) and $SI/silver futures also showed impressive strength last week playing catch up with $GC/gold futures, which has been the only one of the 3 to hold a higher low thus far. All 3 were green.

$CL/Crude Oil futures flushed and then settled negligibly under support, while $XOP/oil equities clung to a modest gain for the week.

Here’s how the week closed out:

For the week ahead (9/12-9/16/22)