Trade Plan for 9/11-9/15

The futures contracts are rolling over. Will the market?

My plan for market price action last week was to short the diamond breakdown ✅💰 and then to buy daily supports if the lower time frames looked supportive. Because of what I would characterize as ‘extreme chop’ in the support zones, I kept my buy trades to scalps and closed flat for the weekend.✅

I was bearish precious metals last week and my plan was to buy support if smaller time frames were supportive. My levels worked well as the high of the week for Silver was 24.655. 🎯

I was bullish crude oil, with a plan to take a countertrend short, but it didn’t give me the set up I was looking for, so I didn’t trade it last week.

This week @SLMacro looks at different investment strategies.

Summary of Market Action Last Week:

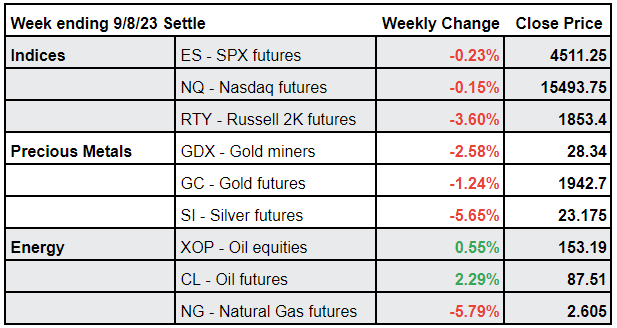

The indices fell from the beginning of the week, but chop consolidated on Thursday and Friday at supports. Because of contract rollover for both $ES/SPX futures and $NQ/Nasdaq futures that created a substantial gap up in the continuous contract on Friday, the market’s futures performance over the last week appears more resilient than it actually was. $ES/SPX futures and $NQ/Nasdaq futures settled marginally down, while $RTY/small caps declined substantially as that contract has not rolled over yet.

$GDX/gold miners declined with the market, but held relative strength midweek. $GC/gold futures and $SI/silver futures.

$CL/Crude Oil futures continued to rise, with $XOP/oil equities holding gains this week.

Here’s how last week closed out:

For the week ahead (9/11-9/15/23)