Trade Plan for 9/1-9/5

Price Action is setting up for a September to Remember!

Last week I was looking to short pops to resistance on $NQ/Nasdaq futures and to also potentially buy any $RTY/small caps futures dips to hold for a long. I did, indeed, buy the $RTY dip early in the week and shorted $NQ on a day to day basis. ✅💰

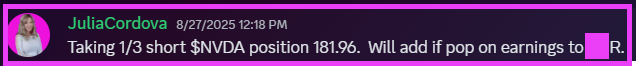

I had been holding out on shorting $NVDA until it got to my measured move resistance, but when I saw the price action prior to earnings (a dip and recovery over 3 points of bearish weekly divergence from a previous week), I could not resist scaling into a short with a plan to add if it had or if it does breach higher into resistance.

I have continued to swing other overbought tech stocks shorts and as I believe it is the best short term swing strategy. So far, I have been correct.

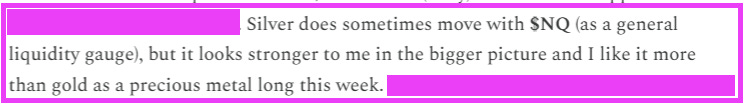

I was slightly optimistic once again for precious metals, particularly silver, but because I had also warned about potential $NQ weakness, I pointed out:

This week I am watching some nearby resistance for both $GDX/gold miners and $SI/silver futures, so maybe they get crazy above there. I know exactly what I am looking for either way.

$CL/crude oil futures continued to do ‘just enough’ for short term bulls, though not fully proving itself, but it was interesting to see a significant breakout for $XOP/oil equities last week amidst only a slight gain for the commodity and weakness/blah price action in tech. 👀

Summary of Market Action Last Week:

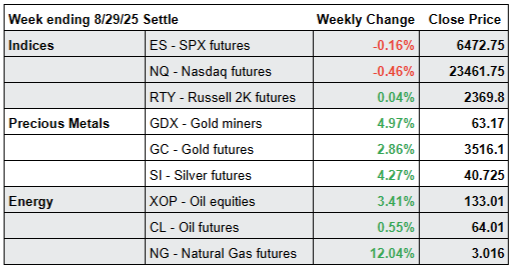

We saw a red Monday for both $ES/SPX futures and $NQ/Nasdaq futures last week, green days Tuesday to Thursday and then another red day on Friday. $RTY/small caps futures was the relative strength leader for the third week in a row.

$GDX/Gold miners outperformed the broad market once again this week. $SI/Silver futures held relative strength to $GC/Gold futures for the third week in a row.

$CL/Crude Oil futures closed slightly green on the week, while $XOP/oil equities showed significant strength for the second week in a row.

Here’s how last week closed out:

For the week ahead (09/01 - 09/05/25)