Trade Plan for 8/4-8/8

Volatility is Back!

Last week I started with a neutral bias because, for me, the indices were between actionable weekly levels. Instead my focus was on daily and hourly levels. My $ES/SPX futures and $NQ/Nasdaq futures levels performed spectacularly over the course of the week. On FOMC decision morning I wrote:

Those were the near exact highs of the day prior to the after hours earnings. 🎯

I shorted there and covered close to the bottom, but I did not flip long. 😐 I did, however, short at the start of the next session and add in the morning on a breakdown back into an hourly megaphone structure I was watching. 🏆💰

I also shorted $MSFT on the open Thursday. I had said Wednesday evening that I wanted to short 549.49 and set an order to short on the open. I verbally reminded the group on the live chart channel and updated Discord as soon as I finished getting set up for the morning.

Precious metals were a disappointment because even though I took down my bias to a minimum, I expected them to perform better. This week we’ll see whether Friday’s momentum to the upside can be sustained. My $GC/gold futures and $SI/Silver futures levels will be key to watch early in the week.

I thought $CL/crude oil futures may dip early in the week, but it was strong out of the gate holding the intraweek key on open and ripped all the way to my next weekly level higher before reversing.

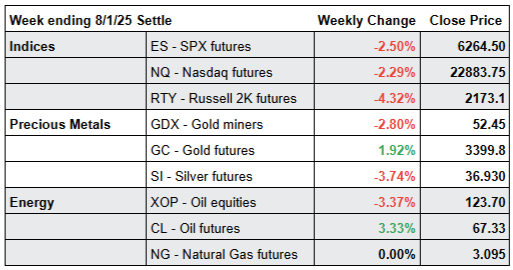

Summary of Market Action Last Week:

The indices gapped up on last Sunday’s open and then chopped downward into the FOMC decision on Wednesday. The price action from the decision was bearish, but earnings after hours ripped $ES/SPX futures and $NQ/Nasdaq futures to new highs after hours. That surge marked the top for the week as we saw a dramatic decline from there. $RTY/Small caps futures was the underperformer.

$GDX/Gold miners lost ground for the week as metals waivered. $GC/Gold futures had a contract roll which gapped upwards and allowed for an arbitrage gap fill. $SI/Silver futures traveled downward with the indices on the FOMC decision, but both gold and silver had a constructive day on Friday despite the weakness in indices.

$CL/Crude Oil futures was strong out of the gate, but rejected against next level resistance. $XOP/oil equities lost ground for the third week in a row.

Here’s how last week closed out:

For the week ahead (08/04 - 08/08/25)