Trade Plan for 8/25-8/29

Rotation vs Gravitational Force

Last week I stayed with a neutral bias once again, but because $NQ/Nasdaq futures had 3 points of confirmed daily bear divergence to start the week, I was looking to sell pops from the outset. ✅💰

Because of the delightful (!) decline, I did start buying $RTY/small caps futures on Wednesday morning. I sold it at the end of the day and bought it again on Thursday morning and then just held it. It was exhibiting relative strength and even overnight on Thursday into Friday morning, it’s the only one of the 3 indices that didn’t stop-run lower.

I continued to hold it into Friday’s Jackson Hole speech event and then closed some and left the office early. 💰

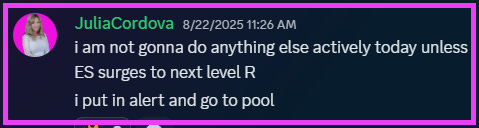

I have continued to swing overbought tech stocks short and as I mentioned last week in the front part of this note, I added a $PLTR short when the setup triggered. 💰 I took partial profit last week after a wonderful decline.

I was slightly optimistic once again for precious metals, and my levels performed phenomenally. SLURP.

I moved my bias to more of a ‘prove it’ for $CL/crude oil futures short term bulls, but despite last week’s gain, it has yet to confirm back inside of a consolidation structure I am watching.

Summary of Market Action Last Week:

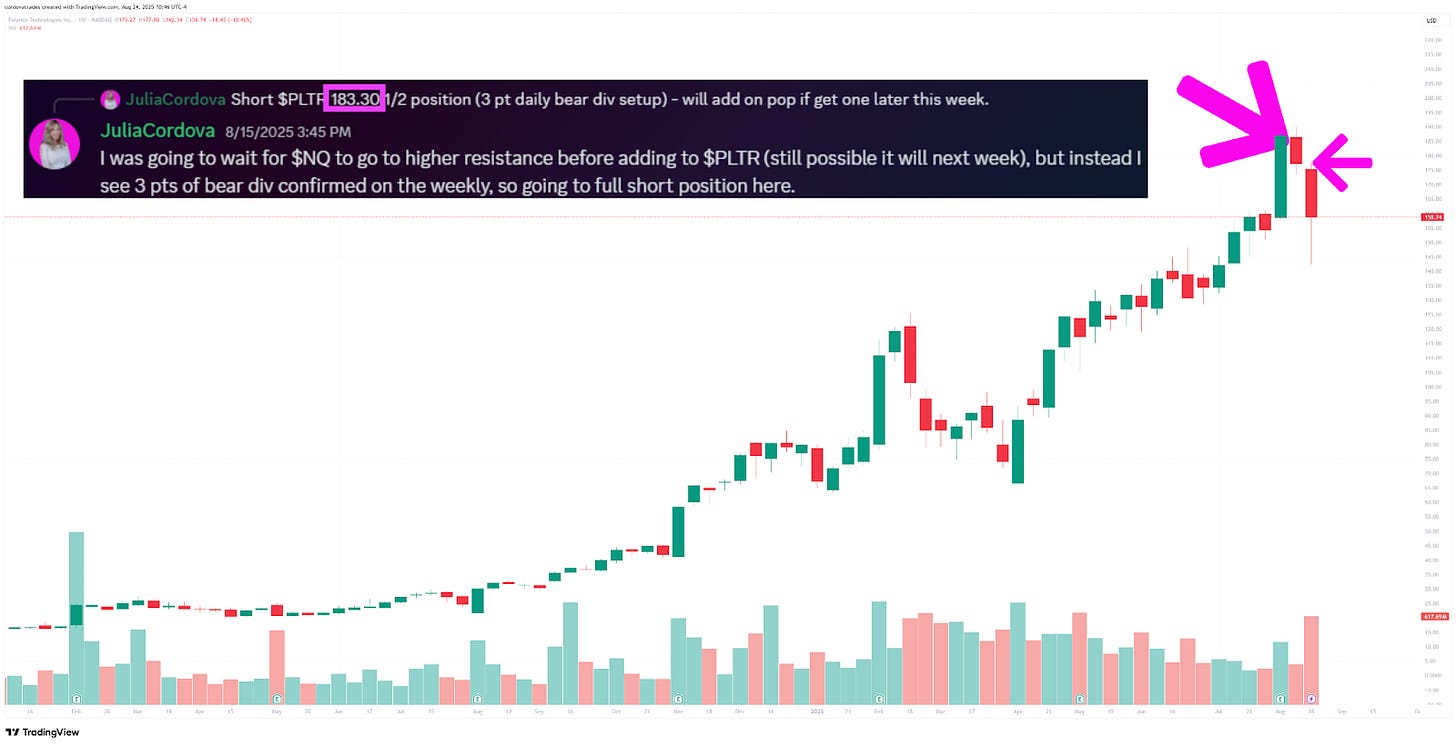

$ES/SPX futures and $NQ/Nasdaq futures declined from Monday into Thursday and then bounced spectacularly on Friday. Still, $ES closed the week just slightly above flat and $NQ lost on the week. $RTY/small caps futures was the relative strength leader for the second week in a row.

$GDX/Gold miners outperformed the broad market this week. $SI/Silver futures held relative strength to $GC/Gold futures for the second week in a row.

$CL/Crude Oil futures closed green on the week, while $XOP/oil equities showed significant strength from an impressive gain on Friday.

Here’s how last week closed out:

For the week ahead (08/25 - 08/29/25)