Trade Plan for 8/22 - 8/26

Wanna Bet?

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Last week I wrote about the 200 DMA for $ES/SPX futures having a lot of eyes on it and a scenario where we may see a textbook rejection before a surge to 4380-4400. We got that textbook reversal/rejection so now the question - if that projection is correct - is how low will it go before it becomes another short or longer term ‘buy’ opportunity?

I added to my gold miners positioning on the dip last week with defined risk and I continue to believe that a bullish oil reversal has begun so if you follow me on Twitter, you saw me live tweet near the lows (86.87) that I was taking the long trade with a stop below the lows that never came💰. Oil reached 91.69 from that low before closing the week at 90.44 :

Fed Chair Jerome Powell speaks Friday morning at 10am Eastern (1400 GMT) during the Jackson Hole conference, so this week will be exciting.

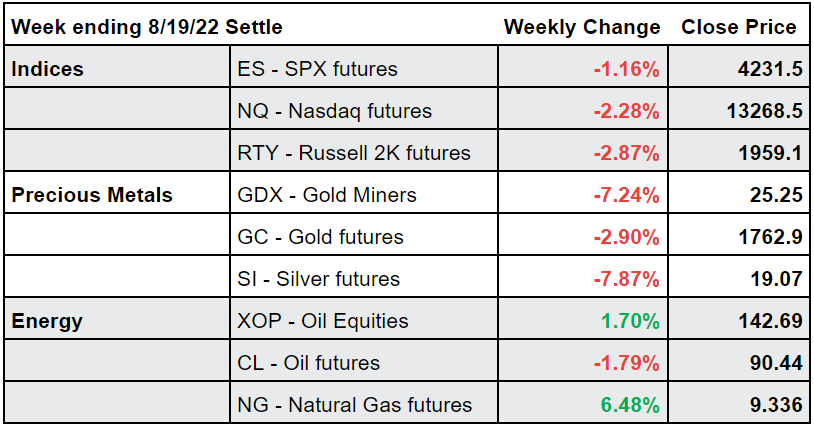

Summary of Market Action Last Week:

$ES/S&P 500 Futures, $NQ/Nasdaq futures and $RTY/Small caps futures all reversed and closed red after $ES hit the much watched 200DMA (@4322 at the time of reversal) and rejected.

$GDX (gold miners) reversed after touching the weekly 9MA and the weekly candle looks unfortunate, but has thus far maintained higher lows. $GC/gold futures and $SI/silver futures followed .

$CL/Crude Oil futures had a slight negative week, but $XOP/oil equities managed to close green showing strength against a broad market selloff.

Here’s how the week closed out:

For the week ahead (8/22-8/26/22)