Trade Plan for 8/21-8/25

Jackson Hole in one or Black Hole

Last week’s price action was a carbon copy of the previous week’s in terms of days: bright green Monday and then red for each of the next days into Friday. There were 2 notable differences: the red days were much greater in size and even though last Friday was red, there was an undercurrent of buying at supports. Although I’ve stressed that we may have seen a local top, I thought that price action could bounce last week because there was an ‘air pocket’ below where we closed. Alas, the market fell into the air pocket and declined to next level supports.

My levels performed well. I had been targeting the 355-363 area for $QQQ as initial downside and the low of the week was 354.71.🎯 We bounced from my daily $ES support of 4353-4356.50 on Friday.

Because I felt that the market may hold above the air pocket for the week, I was also optimistic for precious metals as I believed they would travel together. Gold ended up settling red and right below a potential major buy zone I gave. $GDX continued to decline, but Silver managed to close just slightly off for the week. I did outline a very good silver long trade. The low of the week was 22.265 and it closed at 22.735:

I thought that Crude oil would decline, and it did, but interestingly $XOP/oil stocks managed to recover some losses and closed well, although still red for the week.

This week @SLMacro discusses the recent sell off and looks forward to how he will approach the coming months.

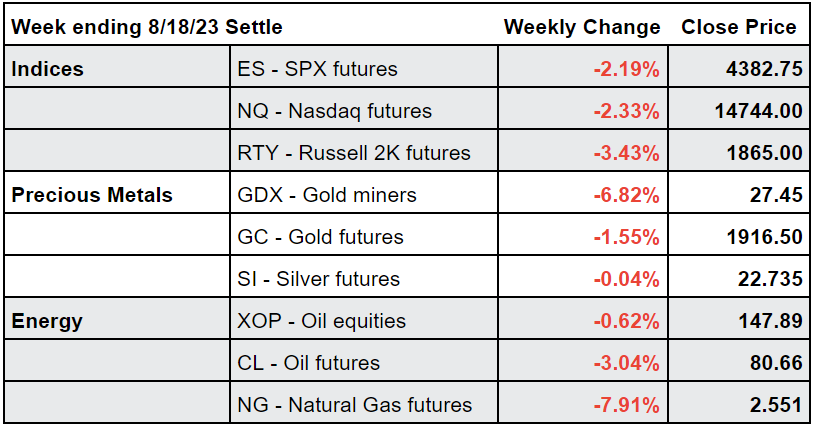

Summary of Market Action Last Week:

After a green day on Monday, the indices traveled downwards for the rest of the week just like last week. The exception was $RTY/small caps. Although it led the week for a loss, it managed to close green on Friday while $ES/SPX futures and $NQ/Nasdaq futures closed in the red.

$GDX/gold miners fell below support and plummeted to decline by the most last week. $SI/silver futures closed essentially flat for the week after a few weeks of blistering red thereby showing relative strength in a sea of red.

$CL/Crude Oil futures closed lower on the week, but $XOP/oil equities contained losses and held just slightly red.

Here’s how last week closed out:

For the week ahead (8/21-8/25/23)