Trade Plan for 7/3-7/7

Fireworks or Open Fire

For the last three weeks I have been watching a cluster of 3 weekly levels/line intersections for $ES/SPX futures. Rather than reject immediately, price action has stalled around these levels while building energy for the next move. Last Sunday I started with long runners, with a plan to reverse/short 5556.50 if reached on Monday. I decided to take that short live in the Discord, took partial profit and then left the rest.💰 Then on Thursday morning I noted a possible inverse head and shoulder pattern that would likely need more chop to fill out the second shoulder and we broke out above the neckline on Thursday evening. ✅

I decided to give precious metals a slight bullish benefit of the doubt once again because, like the indices, they’ve been in chop mode. I was bullish on $CL/Crude oil futures for the week, and recommended taking profit at my double weekly level of 82.39. 🎯

Summary of Market Action Last Week:

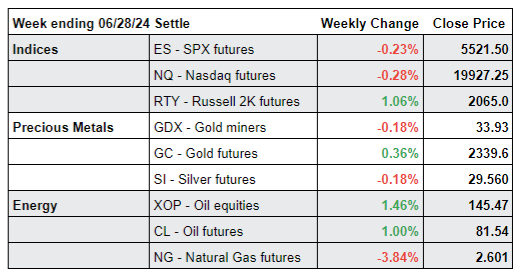

The indices spent the last week of June in chop mode. $RTY/small caps outperformed once again closing higher by just over 1%. $ES/SPX futures and $NQ/Nasdaq futures both closed slightly red.

Like the indices, precious metals chopped and essentially closed flat. $GDX/gold miners and $SI/Silver futures settled with a slight loss, but $GC/gold futures held a nominal gain.

$CL/Crude Oil futures and $XOP/oil equities both gained positive traction last week.

Here’s how last week closed out:

For the week ahead (07/01 - 07/05/24)