Trade Plan for 7/3-7/7

Independence Day: fireworks or explosion?

I started out last week with a slight bearish bias, but as always I looked to my levels for guidance and used my key levels as barometers. For me as long as $ES/SPX futures remained above 4380, I continued buying dips.✅💰 My $NQ/Nasdaq futures bull/bear key level was 15093 with a support level of 14842.50 (low of week was 14853.50)🎯. I bought the dip for $RTY/small caps early in the week and then just continued to hold through Friday early afternoon for a great swing trade. ✅💰💰💰

Here’s an excerpt from my summary for metals last week:

$SI/Silver futures gapped up and remained above my 22.36 key level✅💰, while the low of the week for $GDX/gold miners was 28.76.✅💰

I was (so!) tempted to short oil, but because of the strength in $XOP/oil equities and the recent consolidation chop, I saw better risk/reward elsewhere and didn’t take any oil position this week.

This week @SLMacro looks at sector performance in 2023 and also reviews how his long-hold portfolio as done compared to the S&P 500 and Nasdaq.

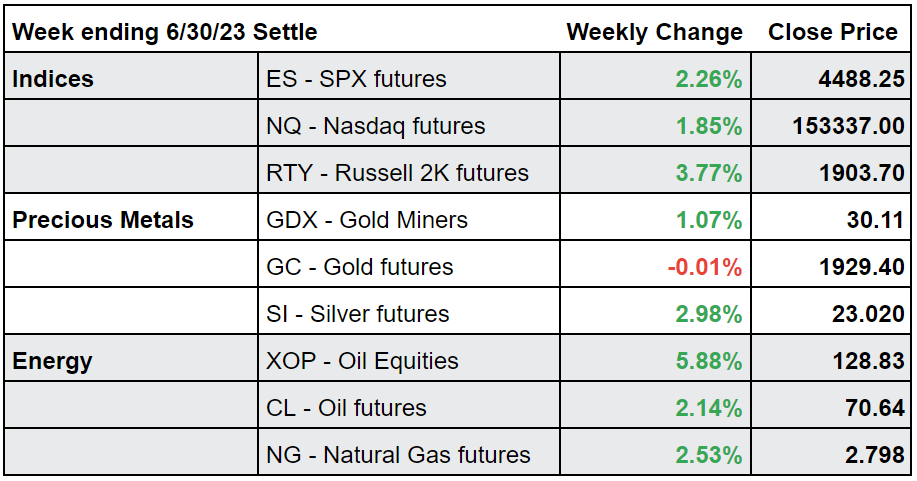

Summary of Market Action Last Week:

The indices dipped Monday, but the rest of the week trended steadily upwards. $RTY/small caps futures went from worst to first to outperform this week, while $NQ/Nasdaq futures booked a gain, but relative momentum waned.

$GDX/gold miners hit support and reversed to hold a gain. $SI/silver futures gapped up and held a solid weekly gain despite late week volatility and $GC/gold futures settled essentially flat, though marginally red.

$XOP/oil equities once again held support and led the week. $CL/Crude Oil futures chopped downwards into the first part of the week, but reversed course on Wednesday to show strength.

Here’s how last week closed out:

For the week ahead (7/3-7/7/23)