Trade Plan for 7/25-7/29

Another planned volatility week!

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Last week I theorized that the indices, metals and energy might all move together and be bullish for the week so I bought the dip. All were bright green until Friday when the market receded causing $GDX (gold miners) to slip marginally into the red. Crude oil retraced as well.

The levels shared last week were 💰.

$NQ bounced right off my lower support of 11859.75 (the low of the week was 11857) and held for a monster rally. 🎯🏆 The high of the week was 12698.5 inside of the previous gap I’ve labeled and it settled at 12423.50 vs my 12402.25 level.

$ES ended the week at 3965 directly on the 3964.25 level given. 🎯🏆. It also topped out at a previously labeled gap.

$RTY got to a high of 1845.6 vs my pivot of 1843.3.🎯🏆

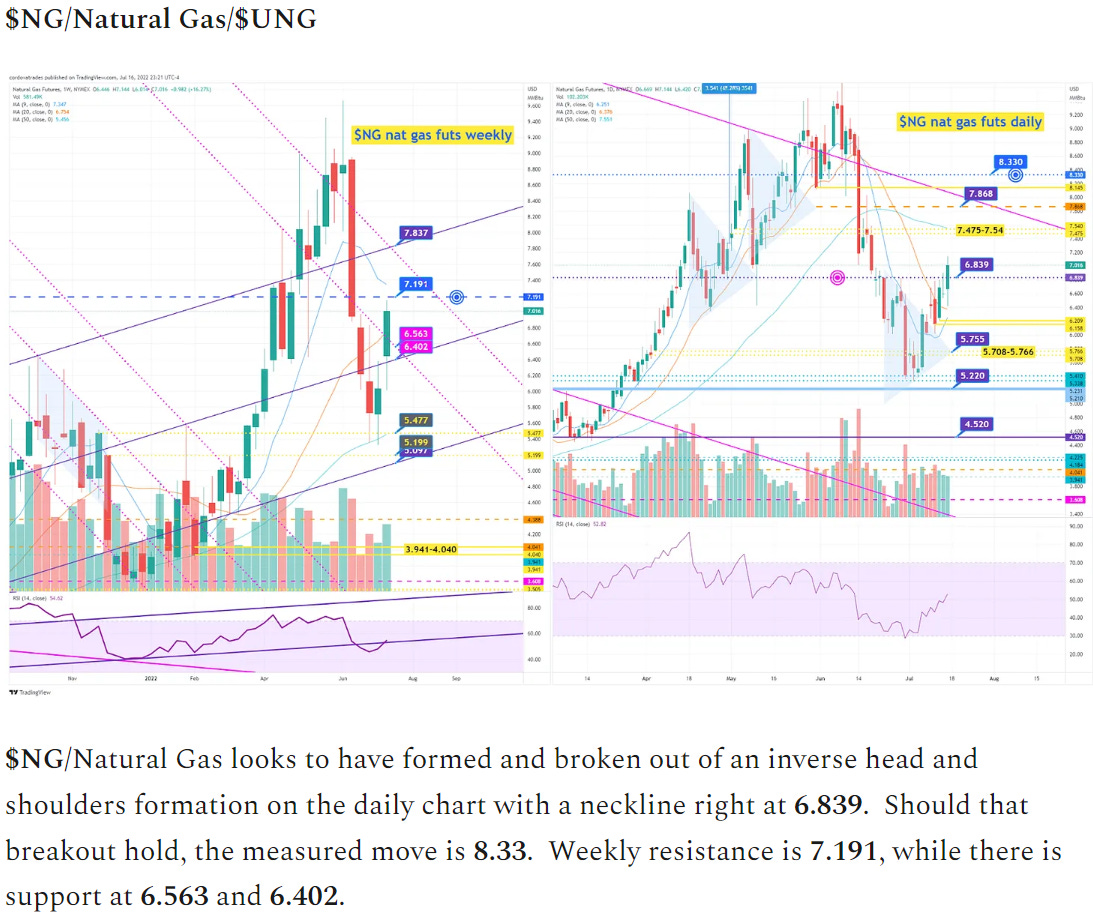

I also nailed the measured move of 8.33 for $NG. Here is last week’s note on $NG:

and the printed candles:

Summary of Market Action Last Week:

$ES/S&P 500 Futures, $NQ/Nasdaq futures and $RTY/Small caps futures all hit their lows on Monday and continued rallying each day until Friday when they peaked inside of previous gaps and then declined closing right at their supports. Ultimately all 3 closed the week with sizable gains.

Precious Metals saw Gold managing to hold strength against the weakness of the markets on Friday and finished the week with a gain for the first time in 6 weeks. Silver also bucked the trend although just barely. Just like the indices, $GDX (gold miners) hit its highs on Friday, but it hadn’t quite amassed the cushion of gains the indices had so it closed the week slightly in the red.

$CL/Crude Oil futures started the week with a gap down, but rallied hard the first part of the week only to lose momentum and close at its lowest level since April. That said, it’s an inside candle and didn’t make a lower low. $XOP/oil equities held enough to close with gains on the week.

Here’s how the week closed out:

For the week ahead (7/25-7/29/22)