Trade Plan for 7/21-7/25

When will this chop slop pop or drop?

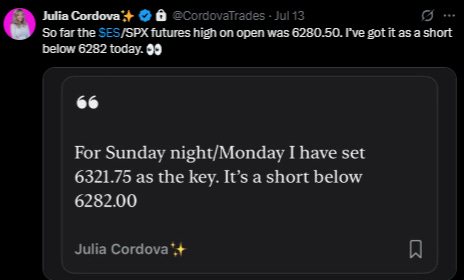

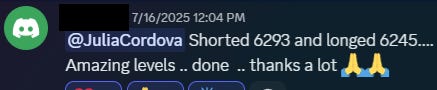

Last week I took another neutral stance for the indices (which makes me feel like a boring person), but price action hasn’t really moved from range for the last 3 weeks, so a neutral stance has kept me from overtrading. I did lean ‘slight bear for the beginning of the week’ because of the way the hourly closed on Friday, and we see a gap down and dump on the open. The specific level I was watching on Sunday night/Monday was $ES/SPX futures 6282 and that level worked well:

Price action recovered the 6282 level on Monday morning and it was a long above. Because of the rangebound chop (I’ve been calling it ‘chop slop’), there wasn’t too much to do other than play the range all week.

I did, however, take a short at the end of the week against a 6353.25 daily measured move I’ve been eyeballing for quite some time. I kept some into the weekend (just in case!).

I was slight bullish for metals, but I did expect some consolidation to start the week. The follow through for $SI/Silver futures was disappointing for bulls, but I have been scalping it well while we wait for some of the exuberance to shake out.

I didn’t trade $CL/crude oil last week, but my levels performed well.

Summary of Market Action Last Week:

Indices chopped again last week with $ES/SPX futures making both a lower low and a higher high, before settling near flat but slightly higher. $RTY/Small caps futures continued to be the laggard for the second week in a row.

$GDX/Gold miners closed the week with another loss and underperformed indices. $GC/gold futures closed near flat but slightly lower, while $SI/Silver futures chopped to give back ground from the outperformance in the previous week.

$CL/Crude Oil futures and $XOP/oil equities gave back nearly all of the gains from the previous 2 weeks.

Here’s how last week closed out:

For the week ahead (07/21 - 07/25/25)