Trade Plan for 7/17-7/21

Meth Bull vs Cocaine Bear (fight!)

Last week I started the week with a low confidence bearish bias because of some hidden bear divergence in the weekly charts, but remained resolute to play both sides from a short term trading perspective, as I did not believe a top had formed. That said, I did arm myself with September puts on Thursday as risk management for my investment account, which has performed quite well this year. ✅

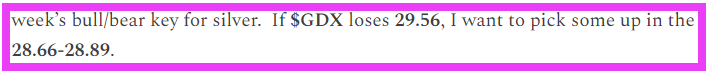

My major profit last week was with metals. I bought $GDX/Gold miners near recent lows for a swing and it outperformed the market by far. From my trade plan for 6/26-6/30:

The low that week was 28.76🎯 and it closed this week up by more than 11% from there after peaking a bit higher. ✅💰 Silver also performed well after I bought it near the lows and bounced just where it needed to last week. ✅💰💰💰

I also bought the oil breakout early last week, took profit, and then sold it to make money in both directions.✅✅

This week I map out key levels and list what I believe to be the bull case vs bear case for the week. @SLMacro looks at disinflation and the Fed’s need for recession.

Summary of Market Action Last Week:

After a dip that got bought on Monday, the indices trended up each day until Friday, when we saw a slight pullback. $RTY/small caps futures saw the biggest gain week over week.

$GDX/gold miners and $SI/silver futures outperformed for the week, while gold showed some life above the consolidation it’s been in for the past couple of weeks.

$CL/Crude Oil futures and $XOP/oil equities both broke out, but then pulled back and $XOP closed only marginally green.

Here’s how last week closed out:

For the week ahead (7/17-7/21/23)