Trade Plan for 6/9 - 6/13

Big inflection week possible

Last week I wrote in the top of this note:

Perhaps the most important level I’ve been watching/trading has been $NQ/Nasdaq futures 21511.75. That level remains a constant on my weekly chart as it’s the center of an old triangle consolidation. I have found that algos respect those center levels as support/resistance very well and we can see that to be the case here.

On Monday afternoon $NQ/Nasdaq futures broke above 21511.75 and held on a backtest Tuesday morning. Then look at the price action on Thursday’s volatility:

So after a 3 week rangebound consolidation, last week we saw breakouts on Friday across the indices. With trade talks and CPI/PPI this week, it’s a question of follow through and knowing the precise levels to watch moving forward.

From a stock swing trade perspective in mid May I closed the last of my $TSLA long at 344:

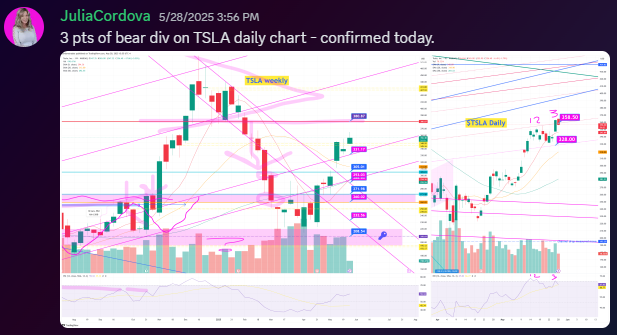

At the end of May I noted 3 points of bearish divergence on the daily $TSLA chart:

$TSLA ended last week at 295.14. ✅

I started last week with a slight bull bias for metals.✅ I would’ve been bearish $CL/Crude oil under 61.05, but the low of the week was 61.06 after a gap up. 🎯

Summary of Market Action Last Week:

$ES/SPX futures broke out on Monday and then chopped all week until breaking out again on Friday. $NQ/Nasdaq futures behaved similarly with a breakout on Monday, holding it into a backtest on Thursday, and then a ‘whoosh’ rally on Friday. $RTY/Small caps futures was the relative strength winner for the week, although it was somewhat muted.

$GDX/Gold miners and $GC/Gold futures were strong into Thursday, but lost significant ground on Friday despite strength across the indices. $SI/Silver futures was the big gainer on the week.

$CL/Crude Oil futures gapped up on the open and rallied providing a nice boost for $XOP/oil equities.

Here’s how last week closed out:

For the week ahead (06/09 - 06/13/25)