Trade Plan for 6/2-6/6

Was it "Sell in May" or are the bulls here to stay?

For the last 3 weeks we have seen rangebound price action across the indices and it’s clear that we are about to see a big move one way or the other. Last week I started out with a slight bear bias with a plan to look for shorts while price was below the intraweek keys I assigned, long scalps above, and/or look for shorts again if price got to top level (“last chance”) resistance levels. On open, price action whooshed above my intraweek keys and remained above for the duration of the week. On Thursday evening I took short scalps over “last chance” levels, but Friday’s end of week/month price action saved the day for bulls.

Perhaps the most important level I’ve been watching/trading over the past few weeks has been $NQ/Nasdaq futures 21511.75. That level remains a constant on my weekly chart as it’s the center of an old triangle consolidation. I have found that algos respect those center levels as support/resistance very well and we can see that to be the case here:

So, was last week a fakey breaky above that centerline after 3 weeks of trying to break above? This week I’m ready either way (or both ways!) with breakout and breakdown levels.

I started last week with a slight bull bias for metals. $GC/Gold futures opened below my intraweek key, got a stick save at my 4hr support, but never eclipsed above my weekly level, while $SI/Silver futures has done just enough. I was slightly biased for crude. ✅

Summary of Market Action Last Week:

Indices opened the holiday week strong last week, peaking on Thursday in the overnight session. Friday’s end of month daily candles continued to show a ‘buy the dip’ pattern. $RTY/Small caps futures continued to lag, while $NQ/Nasdaq futures was the relative strength winner by a small margin.

$GDX/Gold miners held a slight gain despite weakness in the precious metals sector.

$CL/Crude Oil futures declined slightly once again and $XOP/oil equities booked a small loss despite the market rally.

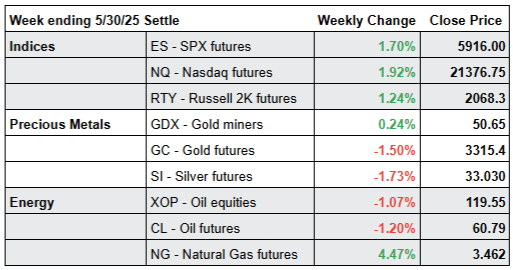

Here’s how last week closed out:

For the week ahead (06/02 - 06/06/25)