Trade Plan for 6/19-6/23

Short week, long protection

Last week I mostly scalped the indices, because while I believed the odds favored a pullback (confidence level 1🍸/5), I also saw a path for the market to explode higher. I did finally take a bigger countertrend position on Thursday when $NQ/Nasdaq futures reached my big weekly resistance of 15286, but the upward momentum continued for the day. The week settled just under that level at 15268.🤔

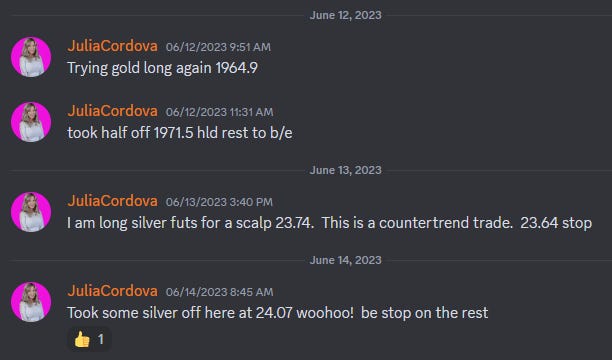

Despite the underperformance for $GDX/gold miners over the previous week, I was low confidence bullish on the precious metals sector once again and bought the dips all week, sharing a couple of my trades on the Discord💰💰:

I was short oil from Friday of the previous week (💰), but scaled out as it turned upwards.

This week @SLMacro discusses how he has begun buying downside protection.

Summary of Market Action Last Week:

$NQ/Nasdaq futures led the charge with strong performance all week into Friday and $ES/SPX futures followed a similar path. $RTY/small caps futures started out strong, but chopped in the latter part of the week, although part of that could be attributed to a lagging contract roll, which the other 2 completed in the prior week.

$GC/gold futures and $SI/silver futures declined in the first part of the week into Thursday morning’s jobs numbers, but rebounded impressively to close the week just slightly lower. $GDX/gold miners eeked out a gain for the week.

$CL/Crude Oil futures descended dramatically on Monday, but then chopped upwards for the rest of the week to close with a gain. $XOP/oil equities underperformed the indices, but held on to close nominally green.

Here’s how last week closed out:

For the week ahead (6/19-6/23/23)