Trade Plan for 7/11-7/15

RIght on the Bubble

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable .

Last week I downgraded the oil bull trade from a high confidence 4🍸 trade bias down to 3🍸, because it closed below my 🗝️ pivot for the 2nd week in a row, but I shared that I felt most strongly about oil having more upside ahead. Oil opened the week to a blistering drop and was down over 12% before recovering to close just over 3% off for the week. I took the opportunity to scalp long a few times and to add to a core XOP/oil equities position using the levels I provided last Sunday adding at 108.53. Here is the chart and pivots I shared with subscribers with the candle now formed:

I also shared setups for the semiconductor index $SOX and biotechs $XBI ETFs. Both had great weeks. ✅✅ This week SLMacro highlights $GOOG and why he is poised to add this to his long term portfolio once the market resumes its uptrend.

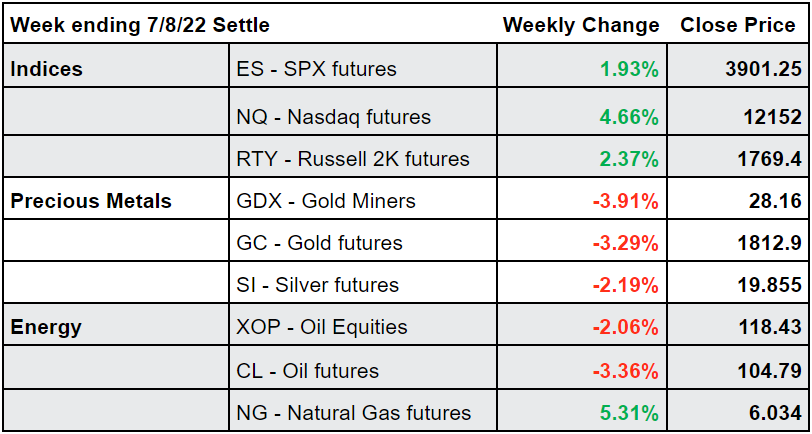

Summary of Market Action Last Week:

$ES/S&P 500 Futures, $NQ/Nasdaq futures and $RTY/Small caps futures closed green this week, with $NQ showing the most strength. They aren’t quite out of the woods yet as all 3 look to have closed at pivotal areas.⚖️

Precious metals and $GDX (gold miners) continued a red candle deluge. $GDX put in a hammer candle, but it’s not the most convincing setup for those who lean long.⚠️

$CL/Crude Oil futures fought back against a frightful decline early in the week to close just a few percent down. That could be a late bull capitulation candle. 👀

Here’s how the week closed out:

For the week ahead (7/11-7/15/22)