Trade Plan for 5/29-6/2

Big breakout for $NQ. Is it leading or will tech be bleeding?

Last week I believed that the previous week’s high would hold for $ES/SPX futures✅ and started the week by shorting $NQ/Nasdaq futures.💰✅ I then ‘bought the dip’ at support ahead of the $NVDA earnings that sparked a momentous rally.💰✅ At the end of the week $NQ/Nasdaq futures were at a major resistance and I took a bearish bet, because I believed that more consolidation would be necessary ahead of a breakout, but price action overcame my 14016.50 level and never looked back. 😐

I had nominal bull metals and bear oil biases, choosing to trade them on a level to level basis.

Summary of Market Action Last Week:

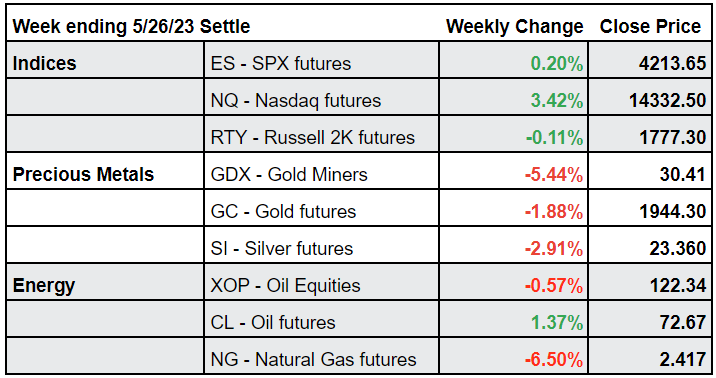

$NQ/Nasdaq futures led the charge this week, breaking out impressively midweek, while $RTY/small caps futures and $ES/SPX futures were a bit more choppy and less decisive, although $ES did close above the 4183 resistance by the most yet, while $RTY closed above its weekly 20MA.

$GDX/gold miners pulled back again last week, but did bounce from support as did $GC/gold futures. $SI/silver futures showed relative strength to closing just marginally red.

$CL/Crude Oil futures bounced from support and showed strength into midweek, but lost ground at the end of the week. $XOP/oil equities followed suit.

Here’s how last week closed out:

For the week ahead (5/29-6/2/23)