Trade Plan for 5/2-5/6/22 - Planned Volatility Fed Week

Featuring monthly charts, a review of our bearish positioning from 3/27/22 and a macro look forward from here.

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and if you find our work valuable please share.

This week we're preparing for a planned volatility Fed week with the interest rate decision on Wednesday. Because this weekend marked the end of April and it was a noteworthy month, I have included supplementary monthly charts for $ES, $NQ, $GDX and $GC for your review this week.

We also take a look back on our bearish positioning in the inaugural 3/27 newsletter. I think we did pretty well nailing the turn from the bounce.🔥

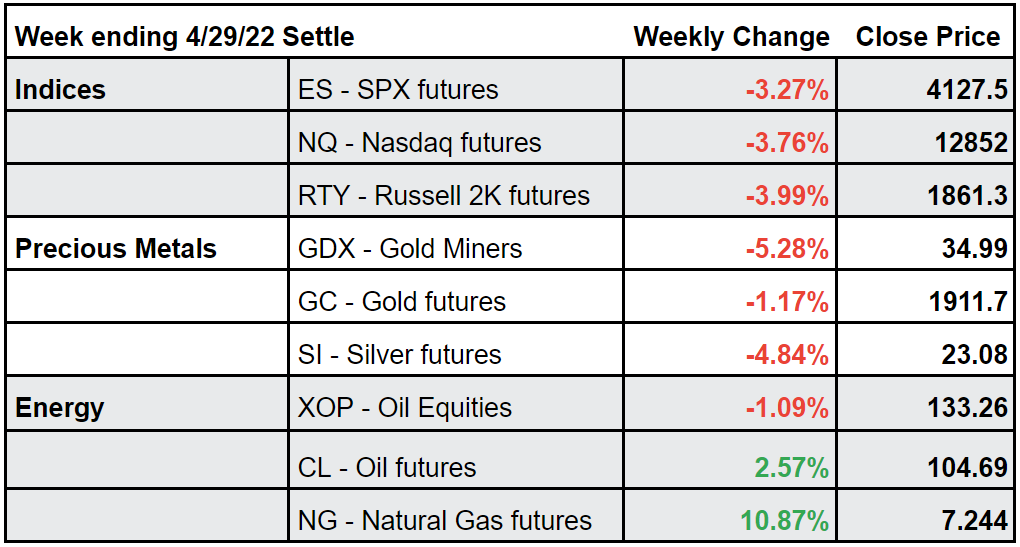

Summary of Last Week:

Last week I used the analogy of any rally being like pushing a boulder uphill and the week’s price action certainly proved that to be the case. That said, volatility kicked in and there were opportunities to take advantage of pivots to profit in both directions.

For $ES/S&P 500 Futures the high of the week was 4303.5 right up against my 4307.75👎 Iine.🎯 Even though my BUY or DIE level of 4183 was breached early in the week, on the recovery back above the bulls got a shot at a push upwards. I issued a midweek update on this breach to alert that if we could recover and hold that level the bounce would be “impressive.” When price backtested 4182.50🎯 on Thursday I live tweeted that I was taking the long scalp there and tweeted once more when I took profit after a quick 95 points.💰 I’d say that was impressive.🏆

Friday bulls failed to maintain the upwards momentum first when I tweeted that I wanted a bounce at around the 4221 hourly support area (that would have been ideal for bulls) and then the final shot was lost when price touched 4183 again Friday afternoon and the week closed abysmally at 4127.50 .

On Friday’s final chance to rally $NQ/Nasdaq futures could not clear and hold my 13376-13417 resistance zone. The high of day was 13433🎯 and after losing the 13127.75 BUY or DIE equivalent pivot, price made lower lows and closed close to them at 12852.

For $RTY/small cap futures I gave a bearflag channel backtest⚠️pivot of 1958.1 and the high of the week was 1957.6🎯 and after price breached my redemption pivot of 1896.9 it made new lower lows and closed near them as well.

I wrote that if Gold failed to hold 1913 it may downdraft to finish filling the gap that it partially filled a month or so ago at 1887.6-1888.3 and it did🎯 with a low of 1870.9 before rebounding.

Oil continued to consolidate sideways with heavy volatility and settle price for the week was 104.69 just a hair shy of my 104.75.🎯

Here’s how the week closed out: