Trade Plan for 5/16-5/20 - No Whammies!

Includes a Moneymaker Macro Primer on where to invest in various growth and inflation environments

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and if you find our work valuable please share.

The markets finally reached what I’ve been labeling as “consensus lows'' last week with all 3 of the major indices bouncing from respective supports exactly when and where they needed to at the end of the week. Last week I wrote:

“A bounce there (from consensus lows) is highly probable but whether that bounce holds is dependent on the weekly close should they hit this week.”

This week we’ll review what I was looking for at the close to see if lows may hold, whether or not we got it and what the short and longer term game plans are.

Summary of Last Week:

$ES/S&P 500 Futures opened Sunday with a gap down opening at 4087.25 against my pivot of 4090.50 and declined into the week slicing through gap support area right into the center of the 3800-3900 consensus lows I highlighted last week, getting the bounce from 3855 vs my 3870.50.✅ We ended the week at 4019.75 inside of … what do you know … that same gap area 4015.25-4021. 🎯

$NQ/Nasdaq futures also careened down from open finally bouncing at 11689 vs my weekly bullflag channel support of 11764.✅

$RTY/Small caps futures was the first of the indices to reach my support levels so we got an early warning sign of the impending bounce on Wednesday when it got to my measured move target of 1715 and did a light bounce before a washout to 1698.3 and then back above for a huge move up to 1789.5.✅

As anticipated, precious metals took a hit last week, but did not bounce substantially. Money shifted back into equities, with $GC/Gold finishing the week below the 🗝️area of 1841.2 closing at 1808.2 and $SI/Silver battling and then finally losing its critical support of 21.41 closing at 21.00. $GDX got as close as it could get to previous lows without ‘price gravity’ bringing it down lower and then bounced with the indices at the end of the week, but isn’t out of the woods.

Oil resisted declining this week, finishing marginally positive despite an early downdraft. Natural Gas had a similar trajectory, but had gapped down for the open, and couldn’t regain positive territory with that setback.

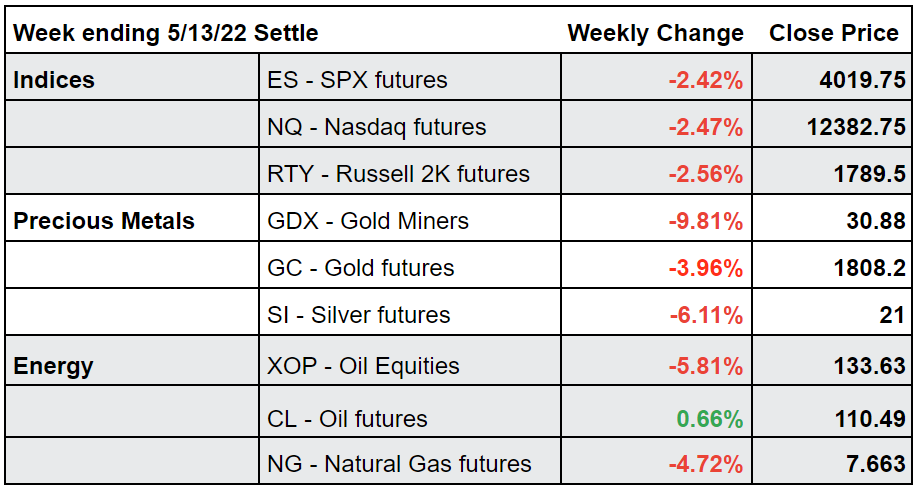

Here’s how the week closed out:

For the week ahead (5/16 - 5/20/22)