Trade Plan for 5/13-5/17

CPI Buy or Die

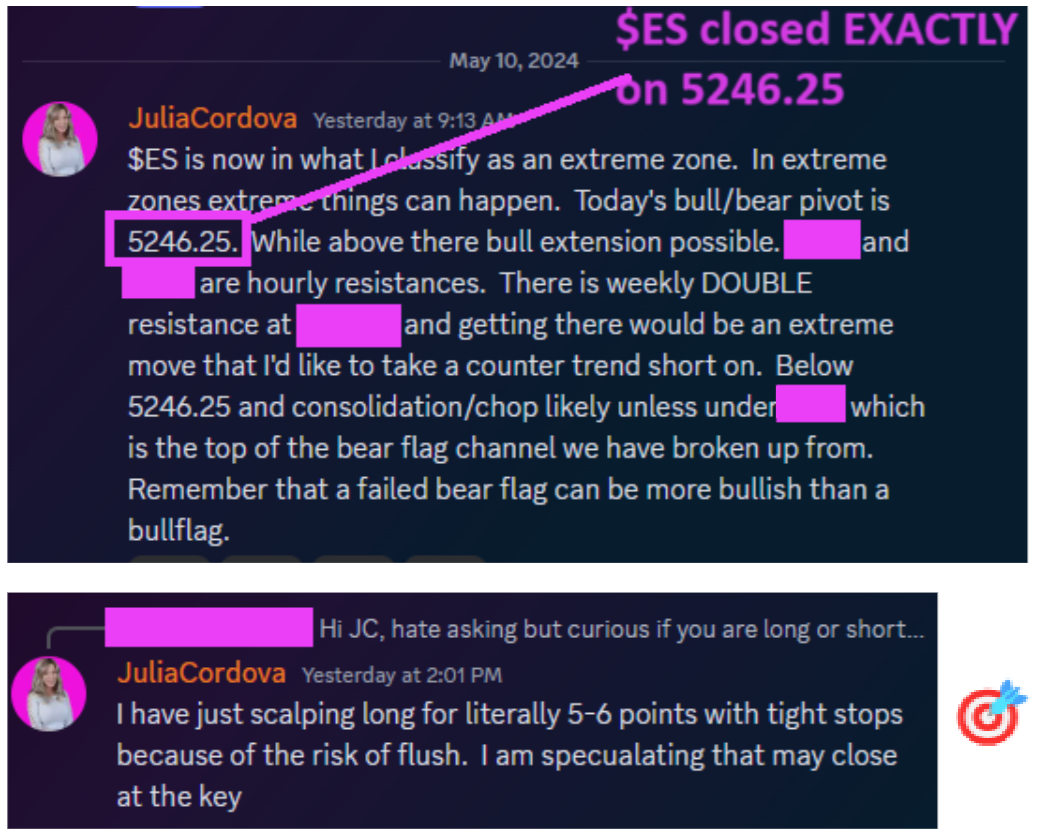

Last week I was once again slightly biased for more upside across the indices, but not without a caveat. I specified that I would be taking long profit and/or possibly shorting at the conflation of my daily and weekly resistances that happened to also line up with $ES/SPX futures and $NQ/Nasdaq futures daily 50MAs and weekly 9MAs. I would long again once above. Sunday night the indices gapped up and the momentum roared into Monday reaching those important resistances directly, but bears fumbled the ball amidst ample resistance lining up perfectly. From that point on in the week I bought the dip as it was presented to me, because I felt the breakout on Monday over those levels was a significant one. ✅💰 On Friday I saw an opportunity to short an extension higher as we were in an extreme zone, but that impulse higher never came and instead I correctly predicted chop once back below my $ES 5246.25 key and in fact bought the the dip once again at my hourly supports to take profit into my intraday key/s. $ES settled precisely at my key. 👽🔮🎯

Although I have been giving updates in the Discord where I stream live charts, I have started posting daily plans to Substack as well for those who don’t use Discord.

I was low confidence bearish for precious metals, but I gave the scenarios in which I would change my mind and Wednesday’s close over both the $GDX and $Silver levels I was watching had me buying the breakouts into a great move on Thursday. I was more confident that my long crude oil position would print, and it did settle the week ever so slightly higher🙄, but it’s been a choppy trade. This week I will discuss whether it may be basing or headed for more downside.

Summary of Market Action Last Week:

Indices gapped up last Sunday night and positive momentum continued through the week. $ES/SPX futures performed the best with 5 green days in a row, while $NQ/Nasdaq futures and $RTY/small caps were a bit more choppy.

$GC/gold futures broke out from a daily diamond formation on Wednesday. After 2 red weeks $GC/gold futures and $SI/Silver futures were strong out of open on Sunday and much like indices carried that momentum forward for the week.

Both $XOP/oil equities and $CL/Crude Oil futures closed the week green, but essentially flat.

Here’s how last week closed out:

For the week ahead (05/13-05/17/24)