Trade Plan for 4/3-4/7

April Foolery

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Last week started within a range in between my weekly levels. I maintained a slight bullish bias for the market, but noted that if price action breached my support, it was likely that we could see the large correction many were already positioned for. Price action did not breach that support level, keeping me in an overall ‘buy the dip’ mindset, and then when it eclipsed my range high of $ES/SPX futures 4059 we saw the “startling up move” I mentioned🎯:

I was low confidence bearish for metals as I was still holding part of a gold short taken above 2000 to start this week and felt that gold may decline regardless of the direction the indices moved. I did note that silver had shown relative strength over the past couple of weeks, and that I expected that continue through last week. Gold closed essentially flat after I took profit lower, but there was an up move for silver and miners setting the stage for an interesting week ahead.

I maintained a bearish outlook on crude oil to start the week, but it squeezed early in the week and eclipsed my threshold for near term bearishness at the end of the week. I shared a short scalp I took on Twitter and mentioned that above 74 near term price action may be bullish.

This week @SLMacro continues his sector look, looking at Industrial stocks.

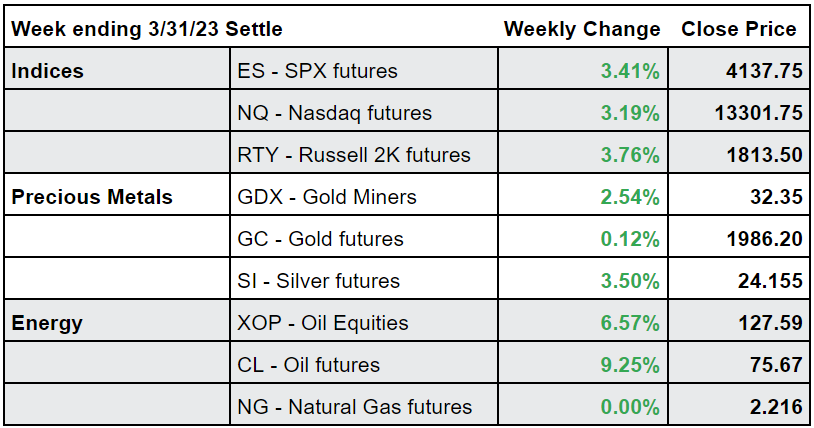

Summary of Market Action Last Week:

$RTY/small caps futs chopped upwards for the entire week and led the momentum. $ES/SPX futures and $NQ/Nasdaq futures started the week by dipping on Monday & Tuesday but then had 3 strong days of gains.

$GC/gold futures and $SI/silver futures continued upward after a bearish start to the week on Monday. $GDX/gold miners booked solid gains for the week again despite a gap down on Monday.

$CL/Crude Oil futures squeezed to start the week and then chopped sideways before resolving to the upside. $XOP/oil equities outperformed for the week.

Here’s how last week closed out:

For the week ahead (4/3-4/7/23)