Trade Plan for 4/29-5/3

April Showers or Yellen superpowers

Last week I flipped to a bull bias, believing that the markets would get a pop at the beginning of the week because we were at my supports.

You probably saw me ‘knife catch’ $SMCI on X at the bottom of a channel I drew in and thought I was a bit nuts, but I was confident enough in my levels to take the trade given my risk/reward analysis lining up with my indices levels. I was right about the pop in the indices, but semis lagged on Monday. I remained confident in the trade because of $NQ/Nasdaq futures overall performance. When the indices dropped on Thursday morning, I noted that my $SMCI was hanging in there, so I played the ‘stick save’ long trade. My levels this week were absolutely stellar and precise across the board. I can’t say enough nice things about them. 🎯💰😂 Here’s the progression thus far:

And the levels I was watching for $NQ on last Monday 🎯💰:

I was low confidence bearish precious metals and oil, but only got the setup to short gold. ✅

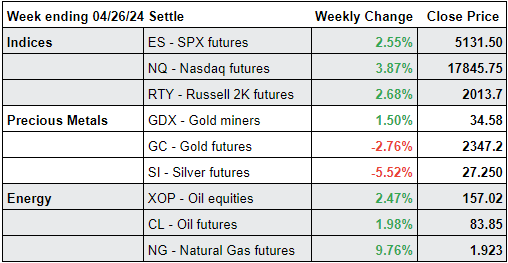

Summary of Market Action Last Week:

The indices finally got a green respite after 3 weeks of increasing red. $NQ/Nasdaq futures led the rally in gains, but none of the major indices were able to erase the declines from the previous week.

$GDX/gold miners showed relative strength last week against a red $GC/gold futures and $SI/Silver futures backdrop.

$XOP/oil equities and $CL/Crude Oil futures snapped back closing with an advance for the week.

Here’s how last week closed out:

For the week ahead (04/29-05/03/24)