Trade Plan for 4/25-4/29/22

with a Macro Overview of the Lithium Sector - White Gold

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share our work if you are enjoying it!

Summary of Last Week:

Last week I expected bulls to put up a better fight than the previous 2 weeks and while initial market supports held well into midweek, Thursday and Friday were relentless selling into the last zones of support and left the market in a precarious position.

For $ES/S&P 500 Futures I gave an initial price support at 4354 and the initial low was 4355.50🎯. Price bounced >150 points before falling like a hot knife through butter closing just below my “high velocity fall” support given of 4265.

For $NQ/Nasdaq futures I gave an initial price support of 13786.50 and price bounced >500 points💰 but did not overtake my 14367.25 🗝️ bull/bear pivot before falling precipitously to my 13417, bouncing briefly and then closing the week under.

For $RTY/small cap futures price flashed above the weekly mid bearflag resistance of 2030 before falling back and closing below the 1953.4 channel support range for the first time but it’s still a higher low for now. 😱?

While GDX/Gold Miners, $GC/Gold futures and $SI/Silver futures remain bullish longer term, all fell from resistances. I had given resistances at GDX 41.42, $GC 1995.6 and a “double” resistance for $SI of 26.365. The highs of the week were 41.61, 2003 and 26.495 respectively and all closed down substantially. Because of these rejections I tweeted midweek that if $SI got to my 🗝️level of 24.945 that it would likely flush lower and it did🎯 to 24.08 before closing just a bit above. $GC closed at 1934.3 right on my triangle support of 1933.9🎯.

$CL/Crude oil futures chopped quite a bit forming another smaller bull pennant on the daily timeframe inside of a bigger weekly bull pennant. I said that I would maintain a bullish bias above 99.91 and the weekly low was 99.88🎯 where price bounced to 105.42 before receding to 101.75.

I also want to note that as we all sometimes have obligations that take us away from the office, I begrudgingly had to leave my office from midmorning on Thursday into evening. While of course I had my phone with me, I had set a trailing stop to protect my long profits. When I first saw the alert that it hit, I was disappointed thinking I may have set my stop too tight, but then my disappointment turned to relief which turned back to disappointment that I hadn’t set an order to flip short back below 4380. These things happen. The lesson is to be nimble and not too greedy in volatile times. It’s ok not to catch every move as others will always come.

Here’s how the week closed out:

For the week ahead (4/25 - 4/29/22)

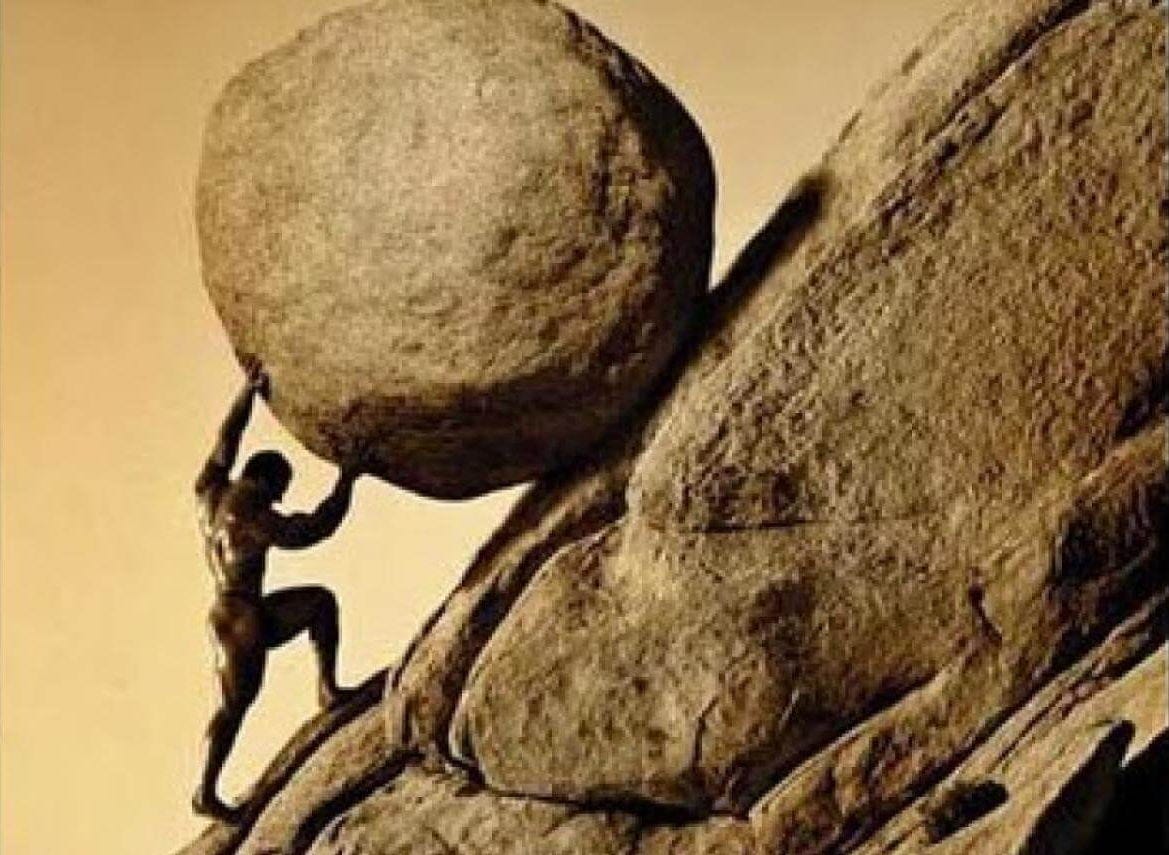

Because of the tremendous bull fumble at the end of this past week, and the decline of commodities with the indices, a rally is now analogous to pushing a giant boulder uphill. The stronger the push and whether or not price clears resistance at the top will make all the difference. This past week I would’ve liked it better if $ES had reached my initial support during Regular Trading Hours (RTH) 09:30 ET – 16:00 ET Monday through Friday instead of the Electronic Trading Hours (ETH) overnight on Sunday/Monday, simply because trend changing hard reversals usually occur during the RTH of the underlying market, but I was open to that support holding and possibly being retested later. It’s my observation that if something like that happens in a critical area, the support/resistance usually either gets retested within a few days or it will hold for at least a few weeks. In this case bulls used up all their ammo squeezing price over the bullflag channel and could not hold the backtest which led to a high velocity flush later in the week as opposed to the optimal path for bulls, which would have been an early week flush popping back to end just above key support. This week I will focus on supports and the next resistances above where we can see trend changes first in the smaller time frames to go long or take shorts back below for another leg down.