Trade Plan for 4/22-4/26

Bounce and/or Bust!

Last week I kept my bear bias, but because of the $ES/SPX futures bullflag and a few other signals, I was open to trading bidirectionally. Price closed below the bullflag channel on Monday and that created a channel break measured move of 5013.25 which was hit on Thursday night.✅ I noted last Sunday:

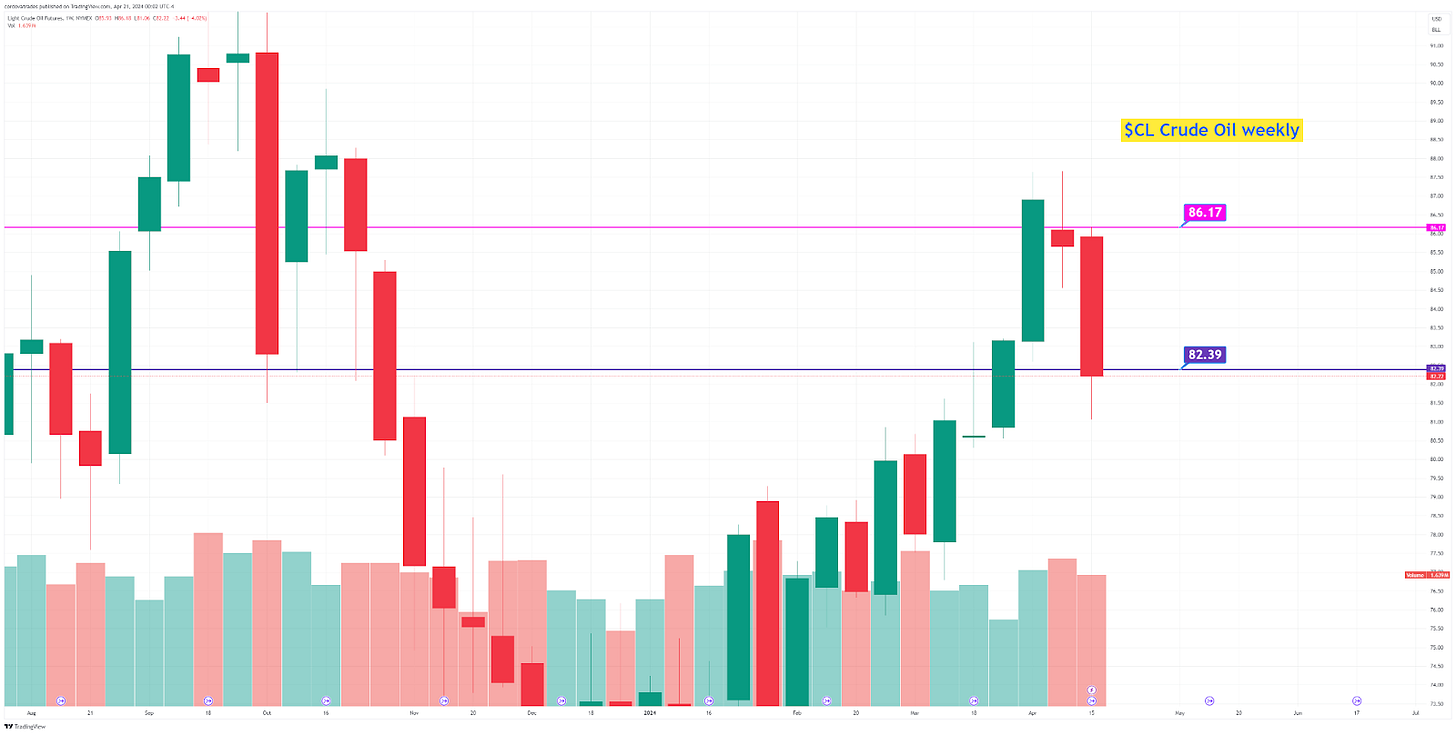

Despite the geopolitical news, I suspected that precious metals would spend the week consolidating and oil may chop or decline. I did not trade the metals last week, but instead shorted oil a few times (the high of the week was 86.18 vs my 86.17👽🎯) and covered most at 82.39.

Summary of Market Action Last Week:

The indices chopped downward for the third week in a row. After 2 weeks of being the weakest of the indices I cover, $RTY/small caps declined by the least last week. $NQ/Nasdaq futures had been holding up remarkably well in the previous 2 weeks, but made up for lost time by declining by the most.

$GDX/gold miners consolidated and ended the week with a modest gain. Both $GC/gold futures and $SI/Silver futures advanced for the week, but held under recent highs.

$XOP/oil equities and $CL/Crude Oil futures declined despite geopolitical turmoil.

Here’s how last week closed out:

For the week ahead (04/22-04/26/24)