Trade Plan for 4/17-4/21

8 tries or it dies

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Last week I remained mildly bullish once again for what I suspected would include another attempt at my 4183 “BUY OR DIE” $ES/SPX futures level.✅ On Friday I shared my thoughts publicly on what I believe will happen on yet another (8th!?) attempt this week:

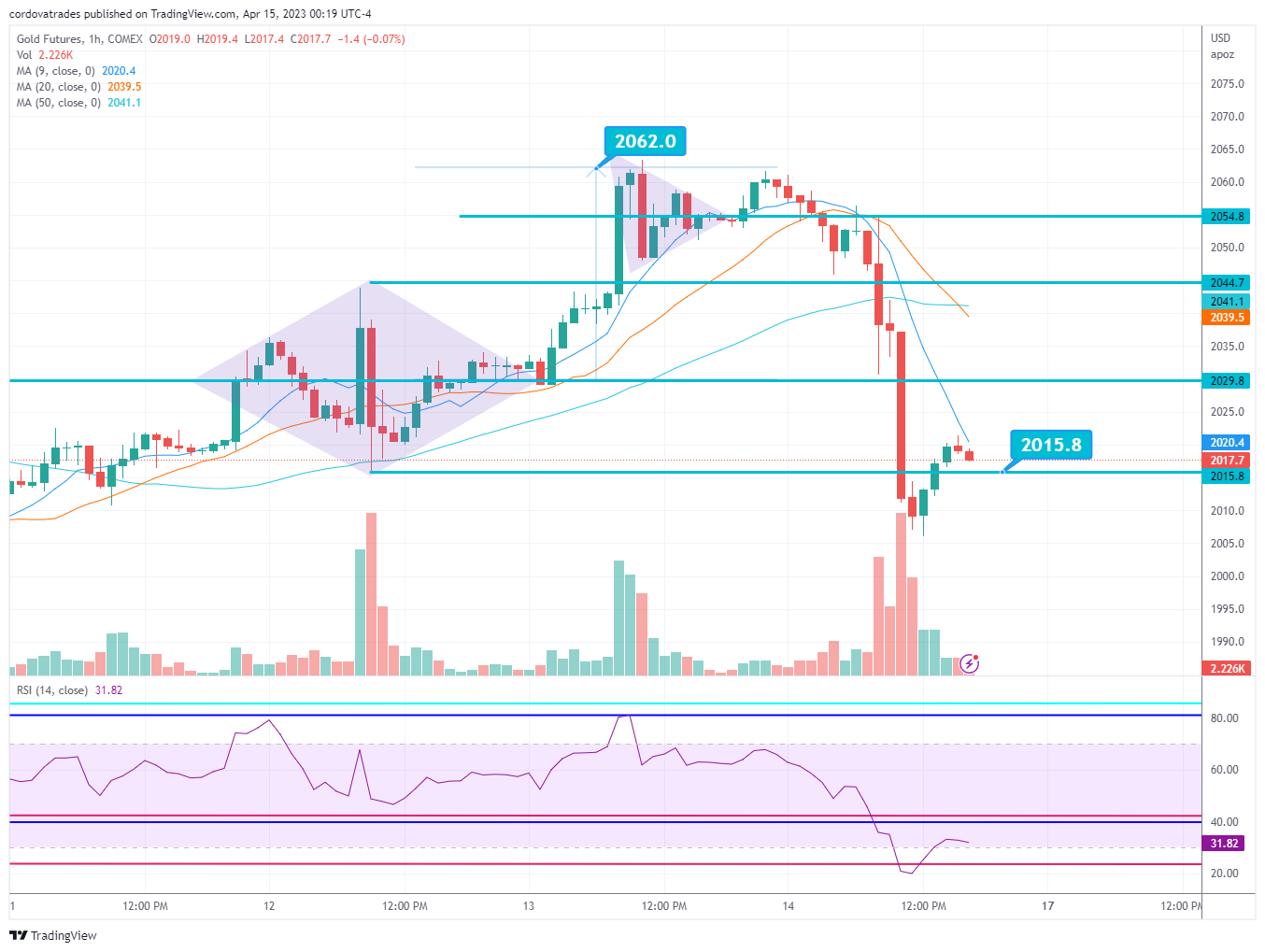

Because both miners and precious metals were still hovering around major resistance, I scalped gold short a couple of times, the last of which was at 2062 shared in the Discord from the 1hr chart Thursday. I took some profit at 2015💰 on Friday:

I flipped back to having a slightly bearish outlook on $CL/crude oil futures, but I didn’t see any particularly good r/r trade setups to actively trade it and it continued its ascent, settling for the week just above a weekly level I’ve been watching.

Summary of Market Action Last Week:

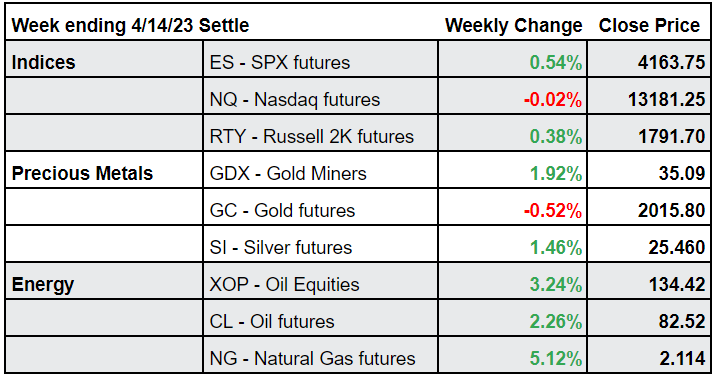

$ES/SPX futures printed a slightly higher close week over week, and that was still the strongest close among the indices. It reached its low for the week on Monday and chopped upwards in a messy fashion. $RTY/small caps futs followed a similar trajectory. $NQ/Nasdaq futures showed more volatility reaching both its weekly low along with its highest daily close on Thursday. It closed the weekly essentially flat.

$GC/gold futures, $SI/silver futures and $GDX/gold miners all printed higher highs and higher lows, but gold did come back on Friday to close the week lower.

Both $CL/Crude Oil futures and $XOP/oil equities also showed higher highs and higher lows and closed the week higher.

Here’s how last week closed out:

For the week ahead (4/17-4/21/23)