Trade Plan for 4/15-4/19

Exciting week ahead!

Last week I slightly elevated my bear bias for the market because $ES/SPX futures closed below my upward daily channel.✅ My measured move target was 5148.50 and Friday’s low was 5150.00.🎯 The most interesting thing about last week from my perspective was $NQ/Nasdaq futures closing down by the least (relative strength) for the 2nd week in a row.

My primary trading focus last week was on precious metals. My summary:

$GC/gold futures hit its major resistance on Sunday evening and then formed a bullflag over the course of the week on the 4hr. It settled for the week right on 2374.1👽. Here’s what it looks like as of close on Friday:

Silver reached my 29.855 major weekly resistance and rejected on Friday 🎯👽:

I am very proud of the precision and accuracy of my levels across the board.

I did not trade $CL/crude oil this past week as I was/am waiting for a bigger move.

Summary of Market Action Last Week:

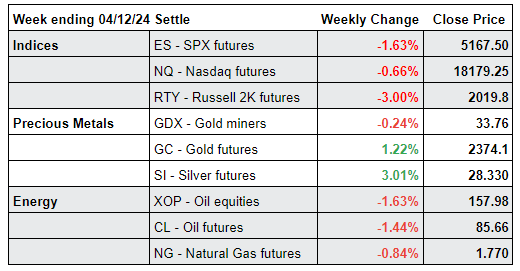

The indices chopped downward again last week. Curiously $NQ/Nasdaq futures saw the least decline. Much of that was because of strong performance on Thursday, but that progress was reversed on Friday. $RTY/small caps declined by the most again last week.

$GDX/gold miners held essentially flat for the week. $GC/gold futures booked an increase and $SI/Silver futures once again outperformed.

$XOP/oil equities and $CL/Crude Oil futures both chopped each making a higher high and higher low over last week, but both settled in the red.

Here’s how last week closed out:

For the week ahead (04/15-04/19/24)