Trade Plan for 4/14-4/18

Was that the badonkadonk bottom?

I was neutral bias to start last week and took a reaction based approach to levels. I had a cluster of weekly supports from 4808.25 - 4909.00 so I looked for longs there.✅ My best trade of the week was on Wednesday as I patiently waited for price to close an hour above my level to get long. I write a short note each morning giving levels to watch/react to. This is Wednesday's note and the accompanying price action with weekly levels marked🎯💰:

I shared a dip buy indices trade on Thursday. I took partial profit near the end of the day on Friday, but I am holding long runners into this week.

I felt that gold was close to an intermediate term top because of 3 points of bearish divergence on the weekly, but I am very proud of how well my gold levels performed. I wrote “Watch the reaction at the 2970.3 support level if hit.” The low for the week was 2970.4. 🎯

I was low confidence bearish for crude, but did not actively trade it last week.

Summary of Market Action Last Week:

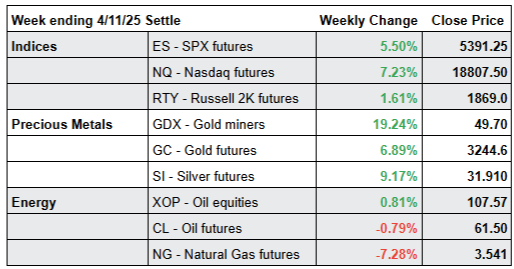

The indices gapped down once again on the open making lows for the week during the Sunday overnight session. We saw wide ranging chop on Monday and Tuesday, with a higher low marked in Wednesday’s session along with a historic rally the same day. Thursday gave back a good portion of that rally, but Friday turned upwards to cap off the week. $NQ/Nasdaq futures was the relative strength winner last week.

$GDX/Gold miners dramatically outperformed the indices given the strong performance in both metals and the market. $SI/Silver recovered just about half of the previous week’s declines.

$CL/Crude Oil futures closed the week slightly negative, with $XOP/oil equities slightly positive.

Here’s how last week closed out:

For the week ahead (04/14 - 04/18/25)