Trade Plan for 3/27-3/31

March Madness

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Last week I was low confidence bullish for indices, metals and energy.🎯🎯🎯 As it was an FOMC decision week my plan was to scalp against whatever strong move happened the first part of the week using my levels as a guide because there has been a consistent pattern of normalization before the Fed decision. Because that normalization did not take place this past week, the reversal was all the more dramatic. We ended the day on Wednesday right at my weekly $ES/SPX futures and $NQ/Nasdaq futures daily support levels, and bounced from there, to then get sold off back to lower supports which were bought up on Friday as I indicated on the Discord may be a trend up day. ✅

During the previous week I ended my $CL/Crude oil short at 66 and flipped long and last week I took profit and then flipped short again as we had reached resistance near term on my smaller timeframe charts.

I thought that metals would continue their move upwards and they did, although I did scalp a cheeky $GC/gold futures short from Friday morning on the move over 2K. 🙀💰

This week @SLMacro looks at his favorite stocks in the tech sector.

Summary of Market Action Last Week:

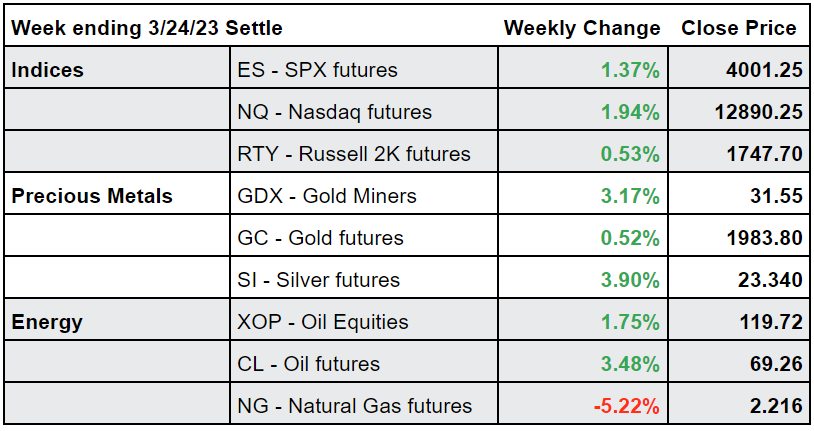

$NQ/Nasdaq futures led the positive momentum last week continuing the trend of being the strongest. While $RTY/small caps futs looked weak at the start of the day on Friday, it managed to rip into a green close for the week.

Precious metals continued upward, with $GC/gold futures making a few attempts to hold over 2K, but declined on Friday against the strength of the indices. $SI/silver futures also continued the short term trend of outperforming. $GDX/gold miners booked solid gains for the week.

$CL/Crude Oil futures chopped upwards to short term resistance and declined, but showed strength with the indices on Friday. $XOP/oil equities held a respectable gain.

Here’s how last week closed out:

For the week ahead (3/27-3/31/23)