Trade Plan for 3/25-3/29

The Grind

Last week I kept my same bear bias from the week before, but as always I had to remain open to interpreting price action in real time as FOMC weeks are typically volatile. My intraweek levels performed exceptionally well.

Here was my overall summary:

I scalped in both directions all week and correctly anticipated that the upward momentum of the Fed would last through Thursday morning.✅ Then I took a great r/r $NQ/Nasdaq futures short at an hourly bullflag measured move of 18707.75. The high of the week was 18709.00 🎯🏆💰 I took over 100 points of profit on that with runners for more:

I maintained my bullish bias for precious metals, but despite upward momentum for the indices the metals couldn’t breakout. More time/consolidation is necessary.

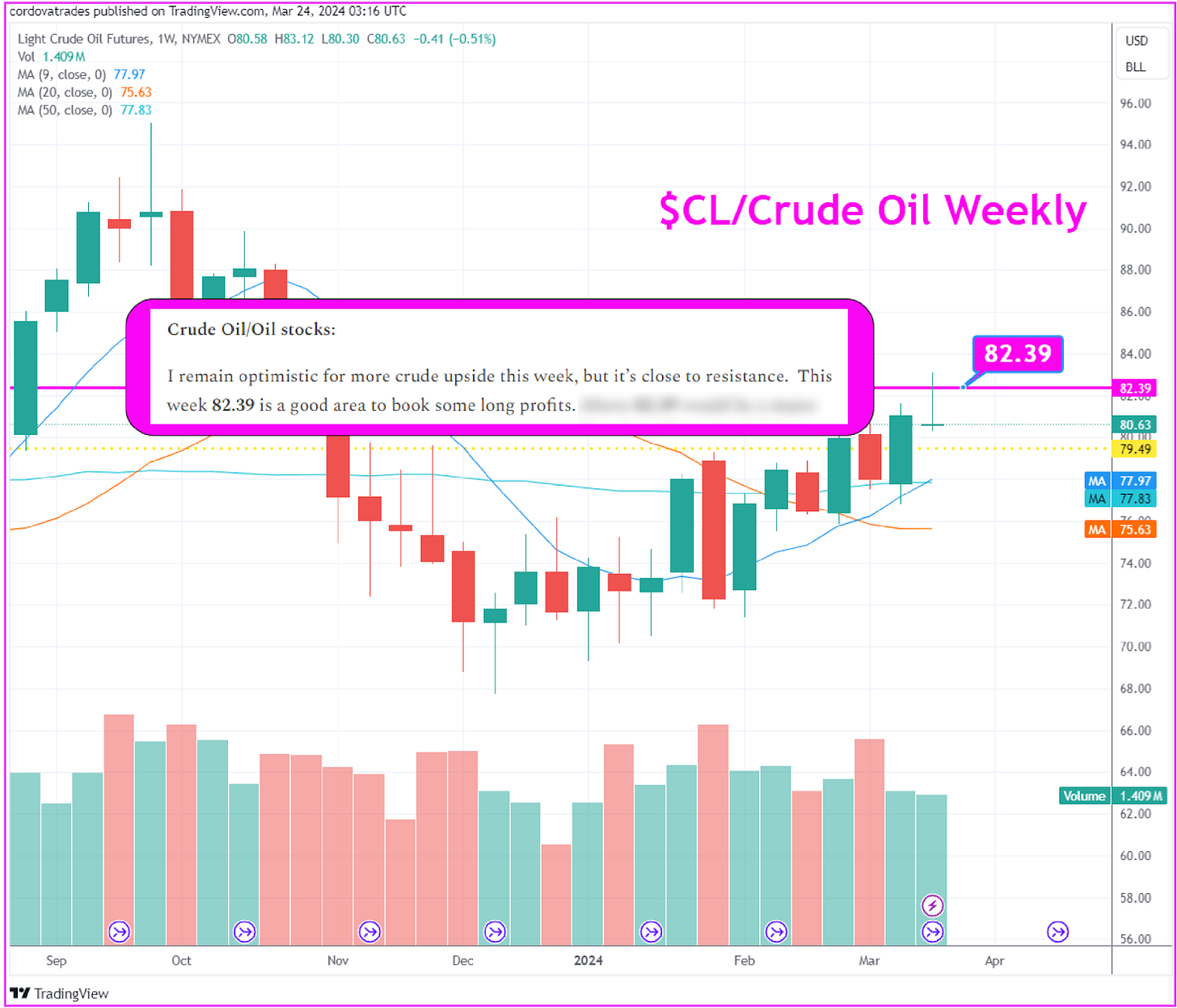

I kept my bullish bias for crude and $XOP/crude oil equities, but recommended that bulls take off some profit at 82.39 for the short term, which I did myself as well.

Summary of Market Action Last Week:

Price action for the indices ramped into the Fed meeting midweek and then peaked Thursday midday with a slight red day on Friday. $NQ/Nasdaq futures and $ES/SPX futures made new all time highs. $RTY/small caps booked a gain on the week, but was the relative underperformer.

$GDX/gold miners made both a higher high and a lower low from the previous week in volatile FOMC movement, and closed the week slightly lower. $GC/gold futures closed essentially flat and $SI/Silver futures gave back some outperformance from the week prior.

$XOP/oil equities continued to grind upwards despite a slight overall pullback for $CL/Crude Oil futures.

Here’s how last week closed out:

For the week ahead (03/25-03/29/24)