Trade Plan for 3/20-3/24

Goldilocks and the market

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Last week I saw a 4🍸 (very high confidence) trade and that was to short oil💰💰💰. I have been short oil since 82.39 targeting 66 for some time now and the weekly consolidation pennant has both exercised my patience and provided many great scalping opportunities, but last week the setup looked amazing for a breakdown. My first support after the breakdown was 65.65 and that was the low of the week before a swipe below on Friday.🎯

The market looked bearish as all of the indices were below key levels, but I was looking for a technical bounce and then/now whether or not those levels will be held. I indicated that the major down move many were expecting last week could be delayed.

Metals still hadn’t done enough at the previous week’s close for me to be bullish, but I gave a ‘change my mind’ level for silver, and that was hit.✅

This week @SLMacro looks at potential banking fallout and his market positioning.

Summary of Market Action Last Week:

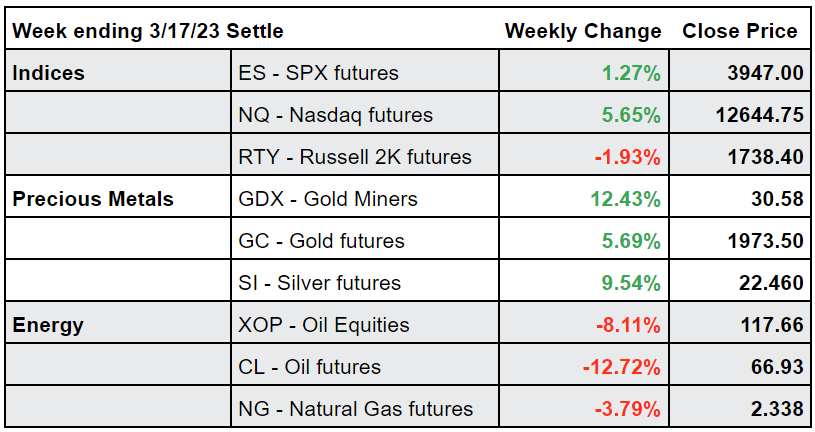

Last week was a mixed or indices. $NQ/Nasdaq futures outperformed, while $ES/SPX futures closed moderately positive. $RTY/small caps futs was the weakest and closed red for the week.

Precious metals ripped above initial resistances and then paused briefly at the next levels before going into parabolic mode. $GC/gold futures and $SI/silver futures closed with impressive gains. $GDX/gold miners looked questionable until Friday when they gapped up and accelerated upwards.

$CL/Crude Oil futures broke down from the weekly pennant and then gave shorts a chance to add back again on a backtest. $XOP/oil equities demonstrated last week.

Here’s how last week closed out:

For the week ahead (3/20-3/24/23)