Trade Plan for 3/18-3/22

Will the bears come Marching in?

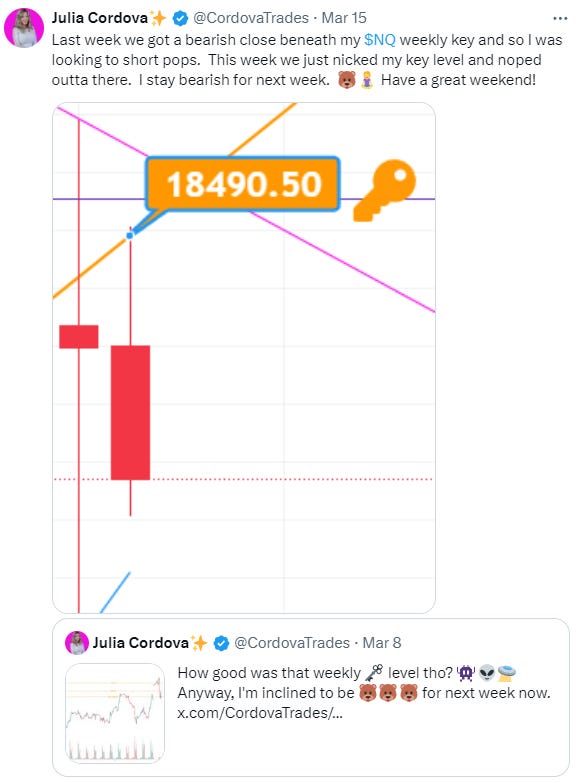

Last week I told you via X and this note that my bias was on the bear side particularly for $NQ/Nasdaq futures. For Moneymaker members I wrote:

My general plan was to “short pops” but I also specified that I would still take longs intraday, which I did for most of the week except for on Friday when I stayed short and just added on pops. My weekly $NQ bull/bear key was 18490.50. The high of the week was 18506.75. 🎯💰

I maintained my bullish bias for precious metals ✅💰 and I was particularly focused on silver because I felt that gold could possibly chop out some of it’s outperformance. For silver I wrote:

Silver settled for the week at precisely 25.380. 🎯💰💰💰! I kept my bullish bias for crude and $XOP/crude oil equities and my levels performed exceptionally across both.🎯✅💰

This week I give actionable bull/bear trade levels across the S&P 500, Nasdaq, Russell 2000 Small Caps, Gold Miners ETF, Gold futures, Silver, and Crude Oil. I give bear targets for any breakdown and I define where my bias will flip bullish.

Summary of Market Action Last Week:

Price action for the indices peaked midweek and declined into Friday resulting in a mildly red week across the board. $NQ/Nasdaq futures lost the most for the week, followed by $RTY/small caps despite being aided by a contract roll. $ES/SPX futures closed just lower than last week.

$GDX/gold miners booked a slight gain on the week, outperforming the indices once again. $GC/gold futures consolidated downward and $SI/Silver futures outperformed.

$XOP/oil equities and $CL/Crude Oil futures showed impressive strength on the week.

Here’s how last week closed out:

For the week ahead (03/18-03/22/24)