Trade Plan for 3/13-3/17

Don't Bank On It

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Early last week I closed longs and short scalped at my pivot of 4081 (high of week was 4082.50🎯) and since $ES/SPX futures 3985.75 was critical support, I felt good about buying the dip felt there. Price action then formed a diamond revolving around 3986.75 as the midline. Thursday morning price action broke upwards and then backtested, but alas after a quick bounce, the bank news took down the whole market substantially.

I was bearish for precious metals and miners describing them as ‘iffy.’ I didn’t feel silver had done enough from a relative strength perspective to warrant being bullish for the week. Both silver and miners closed in the red ✅, but gold eeked out a slight gain for the week after strong upward late week momentum.

I continued to maintain a bearish bias for oil and oil equities. I shorted into my 75.03💩 pivot, and that was my most profitable trade for the week.💰

This week @SLMacro takes a look at healthcare and biotechs

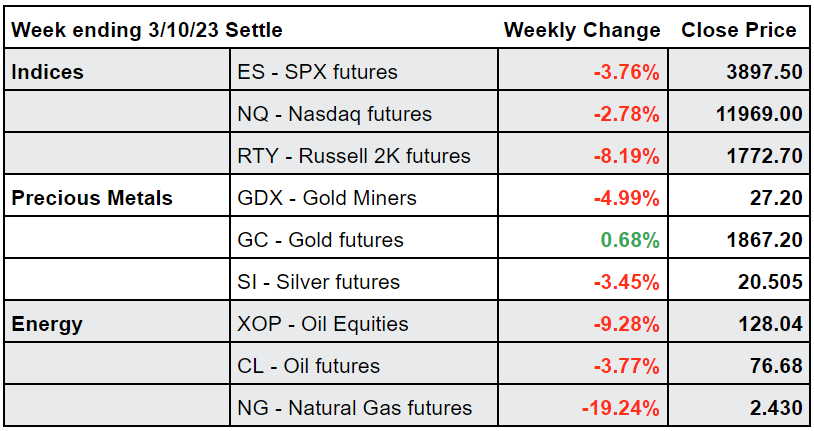

Summary of Market Action Last Week:

$ES/SPX futures and $NQ/Nasdaq futures both looked constructive into midweek, but failed on Thursday and continued to decline through Friday. $RTY/small caps futs bled out towards the end of the week because of the exposure to financials.

Precious metals fell into midweek, but pivoted on Wednesday. $GC/gold futures showed impressive strength on Thursday and Friday, while $SI/silver futures also reversed but couldn’t get back to neutral. $GDX/gold miners looked strong on Friday countering some of the weeks downward momentum, only to fade into end of day.

$CL/Crude Oil futures closed red, but got a bounce from support at the end of week. $XOP/oil equities also closed the week well in the red.

Here’s how last week closed out:

For the week ahead (3/13-3/17/23)