Trade Plan for 2/9-2/13

The indices have been coiling for months. It's almost time for a BIG move.

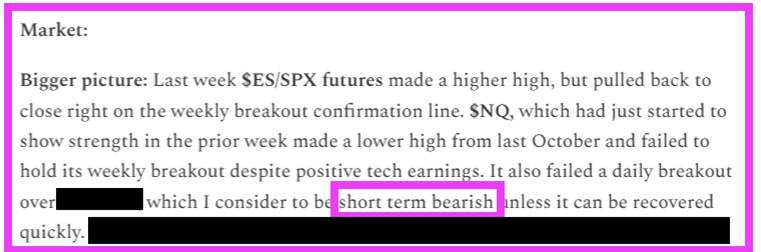

Last week I started out with a ‘short term’ bearish bias for $NQ/Nasdaq futures because of both the inability for $NQ to hold a breakout despite ‘good’ earnings and more importantly a fakey breaky over a daily level.

On Friday morning I resisted the urge to short the gap up at daily resistance and instead went long for the day because of where the remarkable overnight bounce started from … the price action behavior of $SI/silver futures.

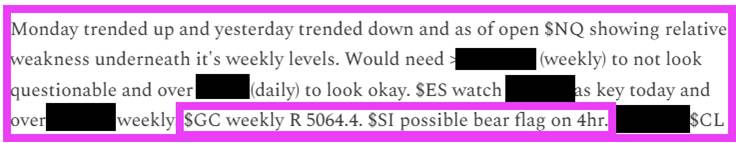

On Wednesday morning I shorted $GC/gold futures live on Discord just at my weekly resistance of 5064.4 and also pointed out a $SI/silver futures bear flag. 🎯

I covered half $GC after a nice dip later on Wednesday and then held the rest with a stop at break even finally covering at hourly support of 4690.0 on Thursday evening.

That was a tremendous trade. 💰💰💰

I did not trade $CL/crude oil futures last week, but it was great to see follow through for $XOP/crude oil equities after it confirmed the breakout in the previous week.

Summary of Market Action Last Week:

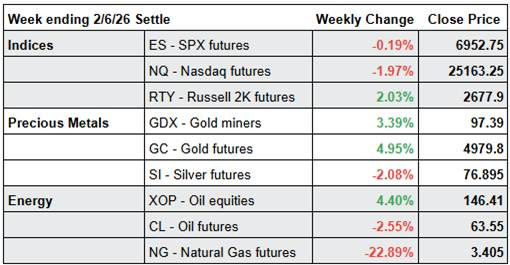

· After a positive Monday, indices declined into Thursday and then staged a remarkable recovery overnight and through Friday. $RTY/small caps futures was the relative leader with a nice gain, while $ES/SPX futures closed near flat for the 2nd week in row. $NQ/Nasdaq futures was the laggard posting a loss on the week.

· Precious metals were wildly volatile, but ‘well behaved’ within levels. $GDX/gold miners and $GC/gold futures posted a gain on the week, but $SI/silver futures declined despite a rally attempt on Friday.

· $ $XOP/oil equities was the equity winner for the week, despite a red close for CL/Crude Oil futures.

Here’s how last week closed out:

For the week ahead (2/9 – 2/13/26)