Trade Plan for 2/23-2/27

Indices still coiling for the BIG move. BUY or DIE levels

Last week I started out with a ‘short term’ downwards bias for $NQ/Nasdaq futures because of the Friday close:

That initial bearish bias came to fruition as we saw the indices dip into holiday trading on Monday and then into Tuesday morning.🎯 On Tuesday morning I bought both $NQ/Nasdaq futures and $ES/SPX futures at respective major supports lining up very well with my levels. 💰✅

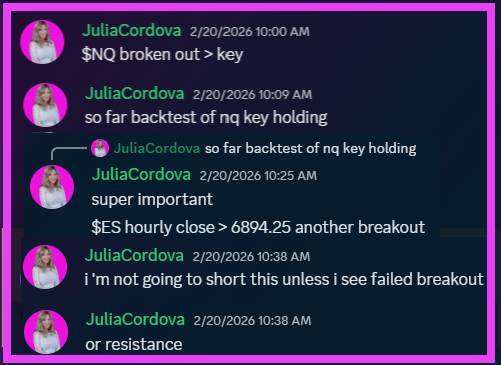

I stream live charts 23/5 and give commentary during RTH. On Friday I was long above important levels and stayed long. Here is a consolidated commentary given in real time on Friday:

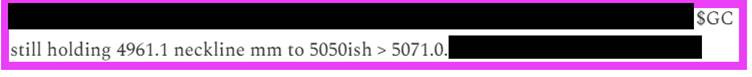

On Wednesday morning I noted an hourly inverse h&s on $GC/Gold futures with an initial measured move of “5050ish” and then added 5071 as a secondary measured move. Both of those hit without violating the neckline breakout we saw Wednesday morning. 🎯🍸 On Thursday I reaffirmed the setup in my morning note:

I did not trade $CL/Crude Oil futures last week, but my levels performed well. I am particularly proud of my $XOP/crude equities breakout call a few weeks back.

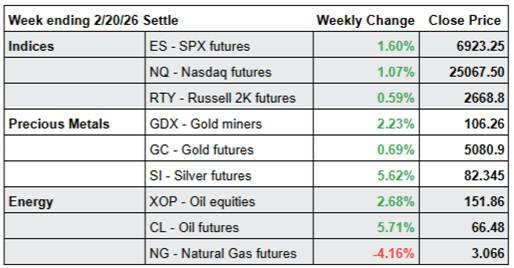

Summary of Market Action Last Week:

· The indices dipped during last Monday’s abbreviated holiday session and hit lows for the week on Tuesday morning. Friday settled with weekly gains across the board and $ES/SPX futures as the relative strength winner.

· Precious metals posted gains for the week. $GDX/gold miners held strength against the indices.

· $XOP/oil equities closed positively for the third week in a row and this time it brought $CL/Crude Oil futures with it. $XOP was the equity relative strength winner for the week.

Here’s how last week closed out:

For the week ahead (2/23 – 2/27/26)