Trade Plan for 2/19-2/23

The chips will fall where and when they may

Last week I outlined a ‘thread the needle’ scenario that I believe came to fruition with the green close for $RTY/small caps futures ✅ and decline in $NQ/Nasdaq futures and $ES/SPX futures✅:

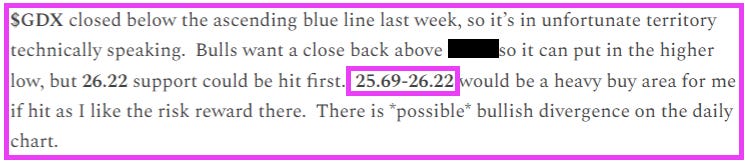

I noted some potential bullish divergence in $GDX/gold miners and gave my ‘heavy buy area’ of 25.69-26.22. The low of the week was 25.68 🎯 before $GDX closed 4.59% higher from that trough.💰

Starting on my note from 1/15 and for a few weeks thereafter I posted this under my market summary each week:

There certainly hasn’t been a large correction at this time, but last week after several weeks of basing, $XOP/crude oil equities surpassed the broad tech sector in terms of performance. Will the trend continue? I will give my opinion in this week’s note.

Summary of Market Action Last Week:

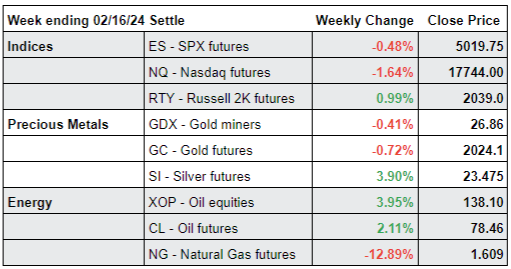

The indices took a tumble on Tuesday, but then recovered higher into Thursday evening. Friday’s OPEX took a toll on that recovery and the indices settled mixed for the week. $RTY/small caps futures held relative strength again this week closing green, while $NQ/Nasdaq futures was the weakest overall.

$GDX/gold miners double bottomed on Tuesday and Wednesday, closing the week just marginally red. $GC/gold futures and $SI/Silver futures followed a similar path, but Silver was able to rally significantly higher and outperformed last week.

$XOP/oil equities edged out silver to be the top performer overall last week. $CL/Crude Oil futures followed a similar trajectory to the indices, but Thursday’s gains were impressive and it held steady on Friday so it progressed for the week.

Here’s how last week closed out:

For the week ahead (02/19-02/23/24)