Trade Plan for 2/16-2/20

YUGE move incoming

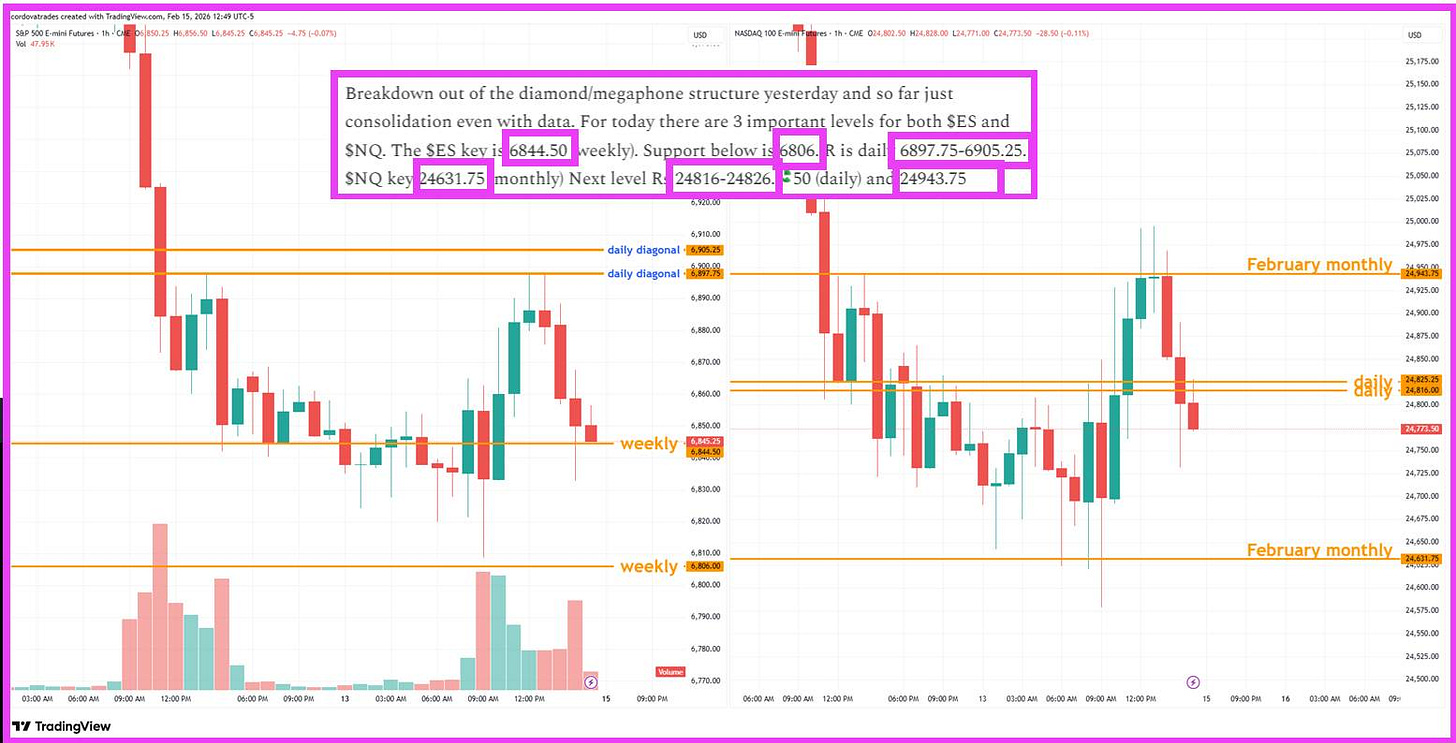

Last week I started out with a ‘short term’ sideways/upwards bias for $NQ/Nasdaq futures because of a false breakdown on the Friday prior, and that turned out to be prophetic as the first part of the week chopped upwards into resistance. The week ended right at critical levels for each of the indices.

In my Friday note I gave 3 levels for both $ES/SPX futures and $NQ/Nasdaq futures – we had a great scalp day! I stream live charts 23/5 and everything was marked clearly.

I expected more consolidation for precious metals and stuck with scalps. ✅💰 $XOP/crude oil futures has outperformed $CL/Crude Oil futures for 2 weeks in row and I’ve got the levels to trade this week to see if that means anything.

Summary of Market Action Last Week:

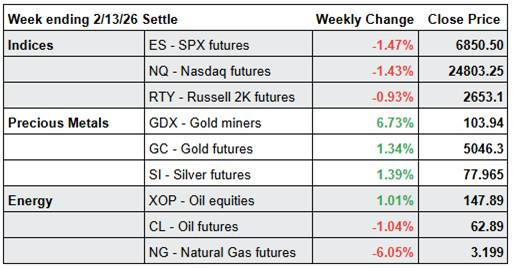

· The indices chopped upwards/sideways through Wednesday, but suffered a large downturn on Thursday. Friday was a day of indecision/balance. All of the indices settled in the red for the week, but $RTY/small caps futures held relative strength closing less red.

· Precious metals continued to chop out recent volatility and held gains. $GDX/gold miners was the equity winner for the week.

· $ $XOP/oil equities closed positively for the week for the second week in a row, despite another red close for CL/Crude Oil futures.

Here’s how last week closed out:

For the week ahead (2/16 – 2/20/26)