Trade Plan for 2/13-2/17

CPI Do or Die

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Last week I didn’t have a strong directional conviction for the market either way as for me we are still in indecision mode, but I maintained a slight bullish bias. My plan was to cautiously look for buys in the 4099-4119.5 area if price action got there early in the week, being careful to take profit incrementally if resistance was reached. We then got to my 4183 resistance💰 before heading back down to lower supports including my $NQ buy zone on Thursday evening/Friday before rising above on Friday.

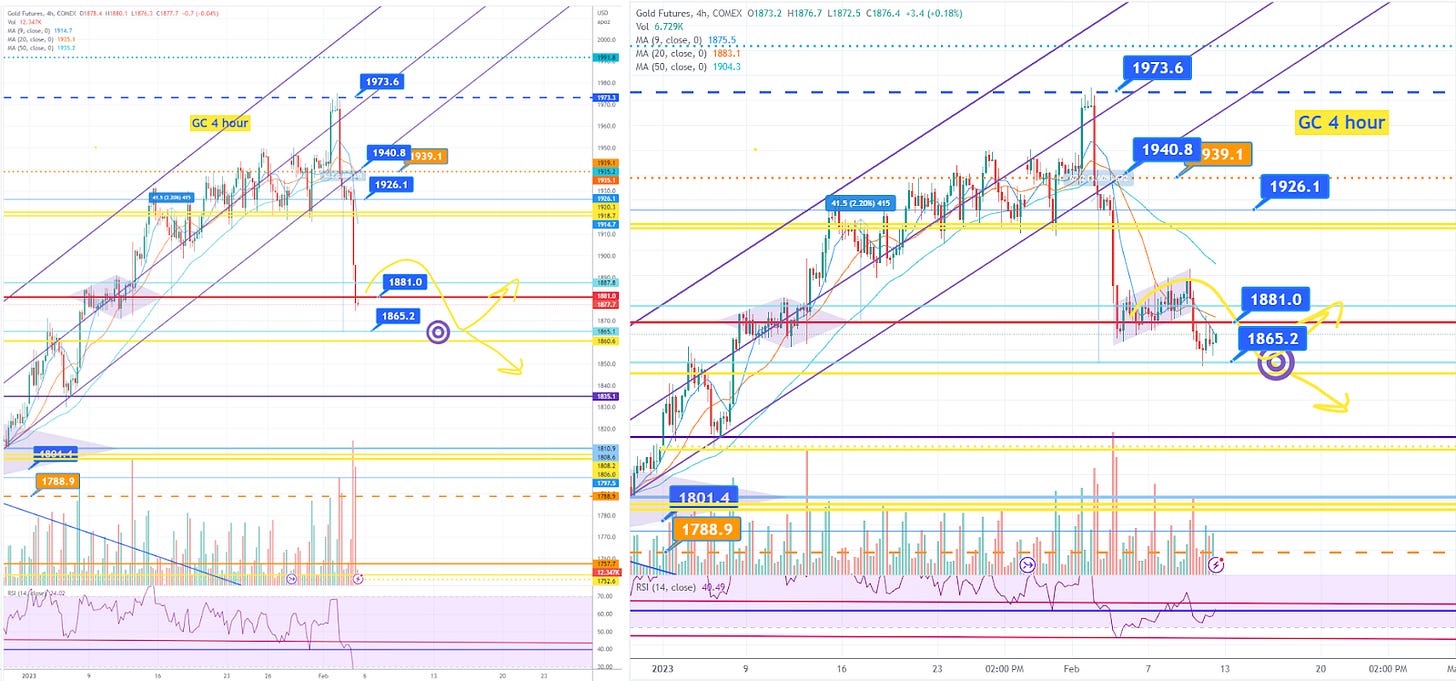

I was slightly bearish for precious metals last week as I expected gold to pop at the beginning of the week and then get to my 1865.2 target before making a decision from there. The low of the week for GC/Gold futures was 1863.5.🎯 Here’s the side by side of my chart given last week with the actual price action:

And my write up:

I was medium confident bearish on $CL/Crude oil, but it got a bounce from my redemption support @72.52 last week and maintained momentum upwards.😑

This week is all about the CPI reaction on Tuesday morning, so I’ll tell you what I’m watching for and how I will trade this week. @SLMacro looks at the yield curve and previous recessions.

Summary of Market Action Last Week:

$ES/SPX futures closed the week slightly in the red leaving an inside candle. $NQ/Nasdaq futures also lost ground for the week with a loss. $RTY/small cap futures went from the strongest in the previous week to the weakest last week.

$GC/gold futures closed the week essentially flat week over week, while $SI/silver futures closed red. $GDX/gold miners declined in line with indices.

$CL/Crude Oil futures and $XOP/oil equities reversed losing price action from the previous week with each closing near the highs.

Here’s how last week closed out:

For the week ahead (2/13-2/17/23)