Trade Plan for 1/9-1/13

And a look at the banking sector :: bank on it or no interest?

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

While I am all about sharing my charts and levels, I am also about sharing insight. 2 weeks ago $XOP/oil equities bounced almost perfectly off of the top of a previous gap 124.72-129.45, which I demarcated in yellow. I wrote that it’s my observation that whenever price action bounces near perfectly from a gap, the bounce is (usually) temporary and price action will continue to partially or completely fill the gap. That’s exactly what happened for $XOP this past week. Price action stopped at my 138.47 resistance, and then It plunged into the gap before ascending again. Nailed it! 🔨

From 2 weeks ago:

This past week the price action dipped into the gap as anticipated. I hope this kind of insight is just as valuable as my levels.

Last week the market tested its range low a couple of times before finally breaking out over the glass ceiling on Friday. I tweeted when I bought my 3818 $ES/SPX futures weekly support the first time and then again when the jobs data release on Friday backtested it. That level held really well throughout the week.✅

I maintained my medium confidence 3🍸 bullish weekly outlook for the market and we saw a surge on Friday to have all 3 of the indices I cover close into the green. I was lower confidence bullish metals, because for me they could have gone either way and… they did with gold outperforming to the upside and silver closing slightly red, but I outlined a threshold close for $GDX/gold miners and they outperformed for the week.💰 I was bearish for $CL/crude oil once again, and that worked out well, but I did take a long scalp live on Discord after it bounced from my 72.52 level, and that worked out also.

This week @SLMacro covers the banking sector and why he is avoiding it.

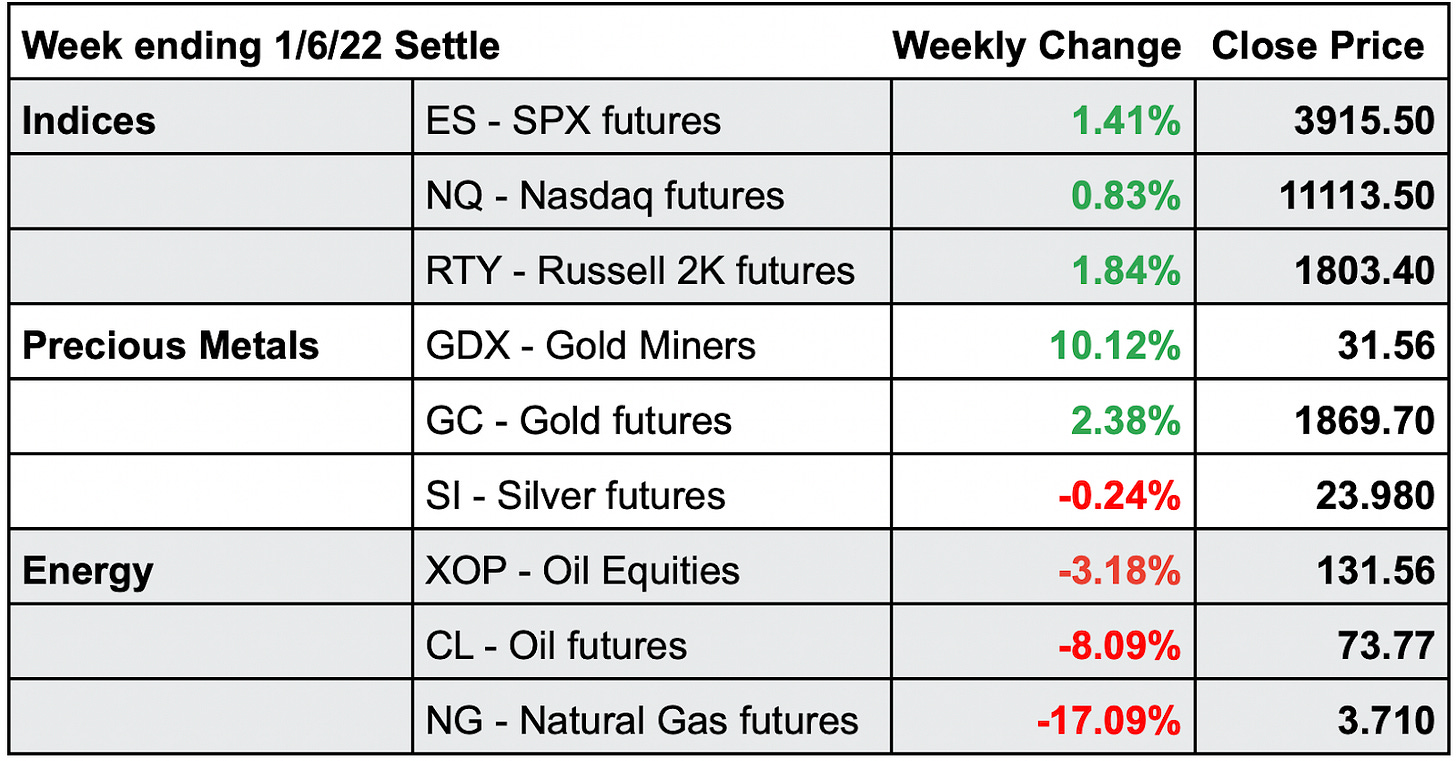

Summary of Market Action Last Week:

All 3 of the major indices closed out the week green, with $RTY/small caps leading the charge followed by $ES/SPX futures. $NQ/Nasdaq futures was the only one of the 3 to make a lower low but just barely missed on a higher high as a counterbalance.

$GDX (gold miners) led the momentum this week, posting impressive gains after flagging under its 50MA for the previous 2 weeks. $GC/gold futures performed strongly as well, but $SI/silver futures closed the week with a slight loss.

$CL/Crude Oil futures sank for the week along with $XOP/oil equities, which closed in the red.

Here’s how last week closed out:

For the week ahead (1/9 - 1/13/23)