Trade Plan for 1/5-1/9

Will 2026 start with a bang or a bust?

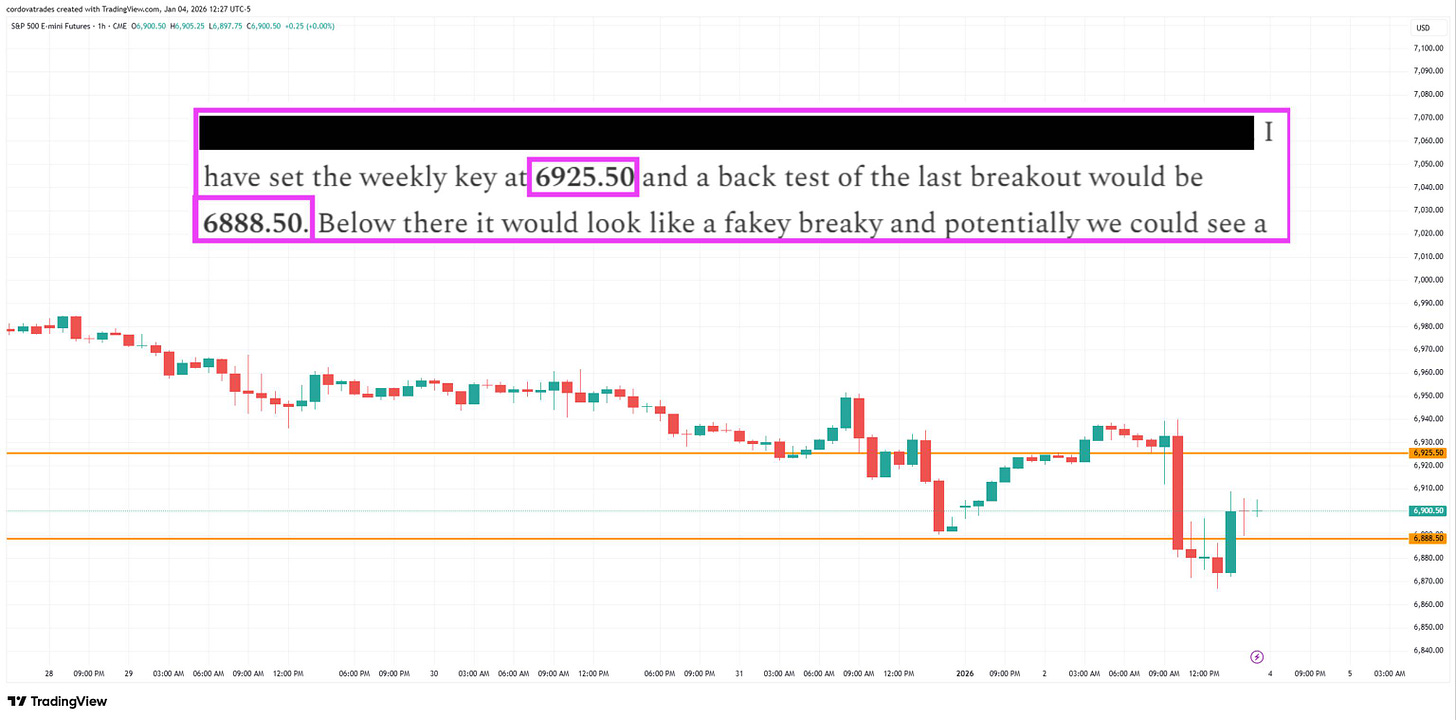

Last week I took a levels based approach to trading and set the intraweek key at $ES/SPX futures 6925.50. Below there I was looking for a backtest of 6888.50, which was a backtest of the last weekly breakout. Wednesday the hourly chart bear flagged across the key and we saw a breakdown that near-missed a backtest of the 6888.50 support before the holiday break🎯. On Friday yet another breakdown set up a great short into the backtest💰and as of the close $ES was hanging on.

After 2 short weeks, the first full week of the new year is set up to be a banger.

I scalped precious metals to the downside last week and maintained a neutral bias for $CL/crude oil futures.

Summary of Market Action Last Week:

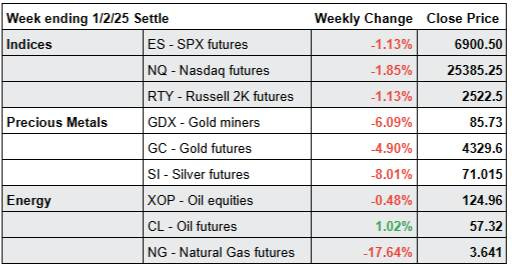

· The indices trended down slowly each day last week before bouncing from lows on Friday. $NQ/Nasdaq futures lost the most ground on a weekly basis, while $RTY/small caps futures showed the strongest bounce on Friday.

· $GDX/Gold miners and precious metals pulled back with the indices. $SI/silver futures led to the downside.

· $CL/Crude Oil futures closed slightly higher, while $XOP/oil equities settled slightly lower for the second week in a row.

Here’s how last week closed out (includes a futures contract roll to the upside):

For the week ahead (1/5 – 1/9/26)