Trade Plan for 12/8-12/12

Will the JPow stocking stuffer be coal or diamonds?

I didn’t have any strong bias for last week as I felt chop was likely and for me it was a tossup how the week would close. I took both long and short trades for the indices. I bought $RTY/small caps futures on the dips twice early in the week, with the first one being a scratch and the 2nd one being a nice winner. I then started looking for an $NQ/Nasdaq futures short close to resistance and layered in strategically for a nice trade.

I scalped precious metals last week, but again I didn’t hold a strong bias or take any high conviction trades because I felt chop was likely. Some weeks are just like that.

I was tracking a breakout for $XOP/oil equities that performed well, but I’m still waiting for $CL/Crude Oil futures confirmation one way or the other before I can have more conviction.

Summary of Market Action Last Week:

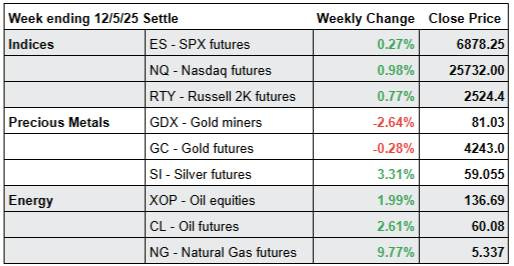

· The indices held a tight range last week, declining at the beginning of the week and then chopping upwards into Friday. $NQ/Nasdaq futures was the relative strength winner for the week, just edging out $RTY/small caps futures.

· $GDX/Gold miners declined last week despite $GC/gold futures basically holding flat and $SI/Silver futures continuing the holiday week rally.

· $CL/Crude Oil futures and $XOP/oil equities continued last week’s ascent.

Here’s how last week closed out:

For the week ahead (12/8 – 12/12/25)