Trade Plan for 1/26-1/31

End of January clutch week incoming

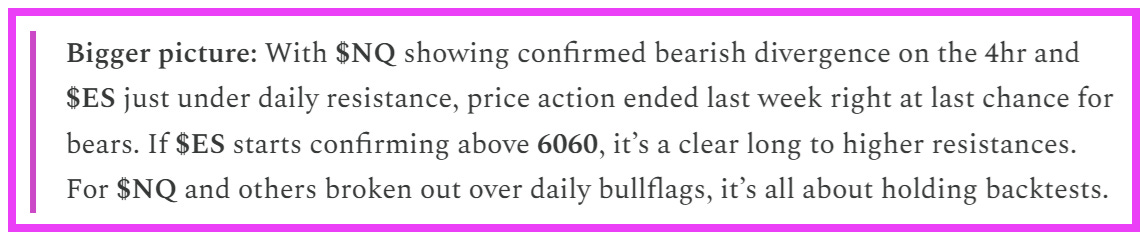

Last week I started the week neutral once again, as the indices closed the previous week right at the “last chance for bears” and there was confirmed bearish divergence on the $NQ/Nasdaq futures 4hr chart.

The indices dropped on the Sunday open ✅ but then reversed and we saw price close over my $ES/$SPX futures 6060 on the first full day of trading. It was a clear long above there into daily resistance on Friday. 💰 Questionable from there.

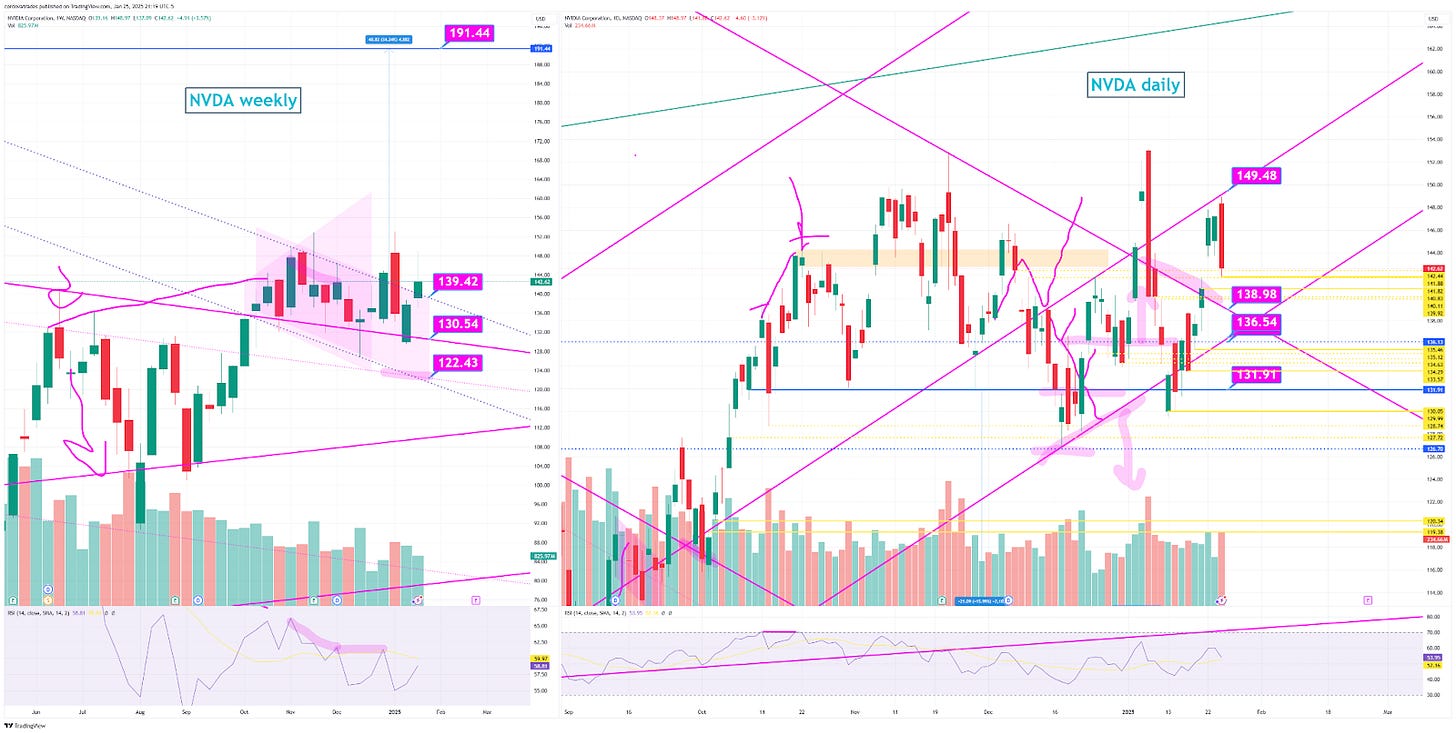

$NVDA strongly rejected from my daily resistance as of Friday, but remains above weekly channel support:

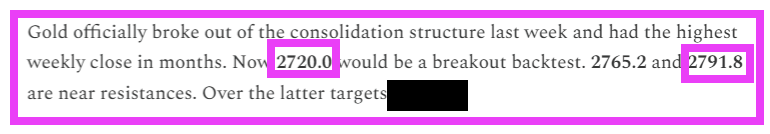

I was higher confidence bullish for precious metals this week. For $GC/gold futures I wrote:

The low of the week was 2715.6🎯 and the high was 2794.8🎯💰

I was bearish for crude and my levels worked quite well across the board.

Summary of Market Action Last Week:

$ES/SPX futures and $NQ/Nasdaq futures exploded upwards into Friday, when they peaked and pulled back. $RTY/small caps consolidated with more chop and backed off of relative strength after 2 weeks of leading a charge upwards.

$GDX/gold miners and $GC/Gold futures once again showed relative strength against $SI/Silver futures, which closed near flat for the 2nd week in a row.

$CL/Crude Oil futures and $XOP/oil equities took a tumble after a four week rally.

Here’s how last week closed out:

For the week ahead (1/27 - 1/31/25)