Trade Plan for 12/4 - 12/8

Blow off or blow out?

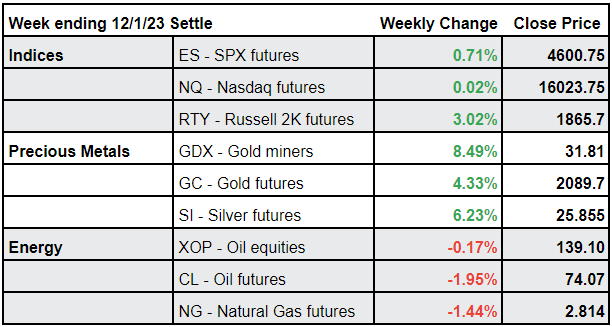

Last week I continued to keep my bias confidence low as we remain in a grind. I did expect range expansion, but even on Friday’s upward thrust, $ES/SPX futures was contained by my 4604.75 weekly pivot.✅ $RTY/small caps, however, did break it’s range on Friday and given that it closed up 3% vs a flat close on $NQ/Nasdaq futures I felt good about my overall take on market action:

I remained long in my precious metals trade (long $SI/silver futures swing trade with some scalp adds here and there). ✅ 💰and my long $GDX swing trade was a big winner especially compared to the indices🤔. 💰💰

Oil closed last week directly on my 74.07🎯.

Summary of Market Action Last Week:

The indices spent the first 4 days of the week chop consolidating and then moved upwards on Friday. Still $ES/SPX futures closed the week only just above last and $NQ/Nasdaq futures closed essentially flat. $RTY/small caps futures, however, broke out impressively on Friday and closed close to high of day.

$GDX/gold miners showed disproportionate relative strength to the market once again, while $SI/Silver futures and $GC/gold futures both continued upwards.

$CL/Crude Oil futures remained in consolidation in choppy trading settling down on the week and at lows, while $XOP/oil equities settled the week marginally red for the second week in a row.

Here’s how last week closed out:

For the week ahead (12/4-12/8/23)