Trade Plan for 12/29-1/2

Did the Santa Rally already happen?

Last week I set an intraweek key and stayed with a bear bias so long as $ES/SPX futures stayed below the level I assigned. On Sunday evening we saw a gap up above that key and it held, as that gap has not been filled as of yet. I gave another level slightly above the key that if breached would likely lead to an all time high and that is exactly what happened.

From an equity perspective, I added to my $MSOS position last week on a backtest of the flag breakout at 4.30 (low of week was 4.29🎯). It bounced strongly afterwards and closed the week at 4.81.💰

I was neutral for precious metals. Silver backtested my daily level and held on Wednesday and then went crazy on Friday.

I maintained a neutral bias for $CL/Crude Oil futures as I await confirmation one way or the other before I can have more conviction.

Summary of Market Action Last Week:

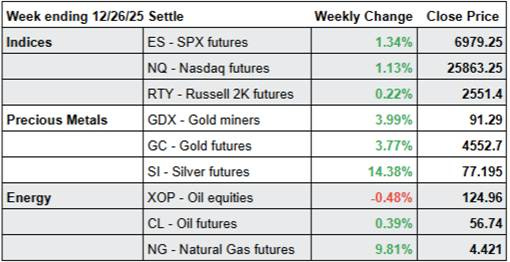

· The indices gapped up on the open and held that gap all week. $ES/SPX futures and $NQ/Nasdaq futures trended up each day except for Friday in the shortened holiday week. $RTY/small caps futures showed relative weakness for the second week in a row.

· $GDX/Gold miners outperformed the indices once again. $SI/silver futures had a remarkable week with a notable rally on Friday.

· $CL/Crude Oil futures closed slightly higher, while $XOP/oil equities was the underperformer for the week settling slightly lower.

Here’s how last week closed out (includes a futures contract roll to the upside):

For the week ahead (12/29 – 1/2/25)