Trade Plan for 12/26-12/30

Happy ending?

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

First and foremost: HAPPY HOLIDAYS to you and your loved ones! 2022 has been a challenging year for many. With my levels and SL’s macro outlook, we have navigated the troubled waters and look to continue to do so in 2023. I am humbled at the amount of support I have received and I hope my levels remain as useful to others as they are for me.

Last week I thought the market may continue the downward momentum and that metals would still hold up bullishly✅✅. My weekly pivots worked exceptionally well:

$ES/SPX futures settled at 3869.75 on Friday right on my ⚠️pivot of 3869 🎯 after dipping below midweek. $NQ/Nasdaq dramatically bounced from the bigger ⚠️ weekly pivot of 10897. That one wasn’t perfect, but it was a fantastic place to take profits in shorts and/or take a long scalp risk/reward-wise because it was a ‘last chance’ before what could’ve been a major drop. I alerted that it was coming up on Twitter:

I retained my bearish bias towards crude oil, but noted a longer term ‘turnaround’ pivot explaining my rationale and thought process. It has yet to cross that pivot.

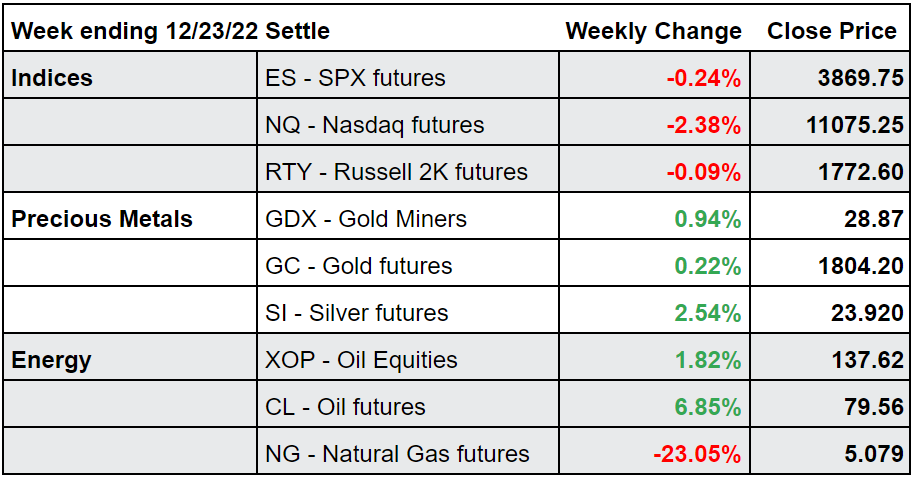

Here’s how last week closed out:

For the week ahead (12/26 - 12/30/22)